About

Welcome to Wealth Orb!

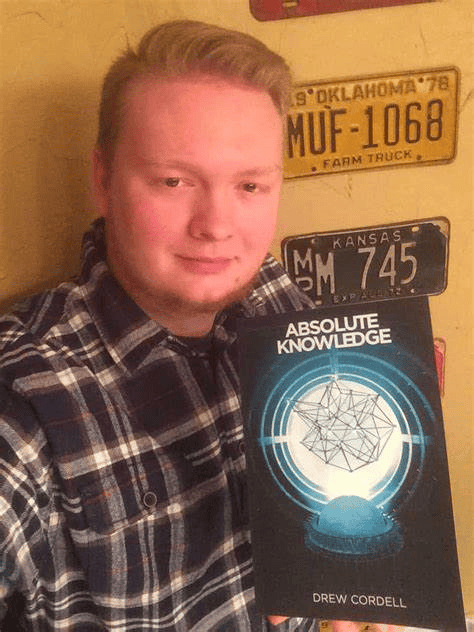

My name is Drew Cordell, and I am the creator of Wealth Orb–a blog that chronicles my journey to financial independence and elevated personal finance.

Wealth Orb is a platform to share all my successes, failures, and the processes, systems, and tools I use to build a better life for my family.

Whether you are just starting on your own journey to better personal finances or are a seasoned pro, it is my sincerest hope that my content will meet you where you are at and help you along the way!

I’ve spent countless hours researching, iterating, and improving my finances. I’m thrilled to share all I’ve learned and show you exactly how these lessons and systems can help in your own finances.

Here’s how my blog will help you:

- Establish a Great Financial Foundation. Learn and master the basic building blocks of personal finance success and walk a path that leads to success. Build a budget, set goals, invest, and watch everything you orchestrate come together.

- Nix the Bad Habits and Embrace Good Ones. Identify and cut the things holding you back financially and aren’t driving happiness in your life.

- Learn and Focus on the 80-20. Prioritize the big-ticket items that will move the needle the most for elevated personal finance.

- Build a Simple, Ironclad Investment Portfolio. Take the guesswork out of it and build a simple but effective portfolio with a buy-and-hold strategy.

- Build Beautiful Systems to Automate your Finances. Spend more time enjoying life and less time buried in the spreadsheet. Automate your finances, decision-making processes, and build heuristics.

- Tinker and Iterate. Personal finance is personal. Tinker and iterate on your systems and make it work for your success! Explore how to build on the basics you’ve mastered and ways to use tools, platforms, and systems to your advantage.

- And Much More!

Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Cornerstone Concept of Wealth Orb: Incremental wins and sustainable strategies compound over time, turning seemingly insignificant changes into the building blocks of incredible future milestones.

My Story

I’ve always been interested in business, entrepreneurship, and personal finance. In 2017, I graduated from the University of Texas at Dallas with a degree in Business Administration and a concentration in Innovation and Entrepreneurship.

In my career, I’ve worked my way up from an entry-level marketing specialist to a technical project manager at an IT consulting firm. Through luck and hard work, I’ve been fortunate to build a strong foundation for my career in a job and industry I enjoy.

I’m also passionate about personal finance.

Since 2013, I’ve become a financial sponge. I stay up to date with the FI(RE) community and countless personal finance blogs. I comb through IRS documentation. I read business news every morning. I read at least one business & finance book every week. And in my own quest to build financial independence, I’ve learned a lot along the way and want to share my knowledge and the systems and methodologies I’ve built with you.

I’m also passionate about writing. I got my start freelance writing cryptocurrency news articles in 2013, my freshman year of college (no, I’m not a Crypto Bro and no longer hold any cryptocurrency investments).

I wasn’t interested in working at a traditional minimum wage college job for some extra spending cash when I could show up to campus a few hours before class, buy a cheap cup of coffee, and sit down and pound the keys on my Chromebook.

After three years of tirelessly writing for others, I decided to write for myself.

I took a leap of faith and crowdfunded & published my first science fiction novel in 2017, writing the story I always wanted to read. Since then, I’ve published six total novels and have been writing in one form or another on many other projects as well.

The truth is, if I’m not at least chipping away at some kind of writing project, I’m not entirely fulfilled. And what better to write about than my love of personal finance?

I’ve been dreaming about starting this blog for years but kept on coming up with every reason–any reason, not to start. Just like I did when I published my first novel, it’s time to take another leap of faith.

In the decade that I have been freelancing and running small internet businesses on the side, I’ve come to realize how much value there is to entrepreneurship and having at least one source of self-employment income for those pursuing better personal finance or FI.

Building a business on the side gives you access to potential tax deductions and additional tax-advantaged retirement accounts that you wouldn’t have otherwise. These benefits extend well beyond the extra income you can earn from business profits–they rewrite the rules and open up new ways of life.

I’m excited to share my journey with you.

The 80-20 Rule

You’ll see the 80-20 rule mentioned a lot on my blog. The 80-20 Rule (also known as the Pareto Principle) asserts that 80% of outcomes & outputs are the result of 20% of the inputs.

I believe it’s essential to prioritize the 20% of inputs in personal finance that yield the biggest results and increase the chance of more favorable outcomes… But what about taking things to the next level after you’ve already mastered the fundamentals and locked down the most important 20% of inputs in personal finance?

With the key fundamentals & inputs of personal finance mastered, then it’s time to iterate and experiment with automation, processes, systems, and tools to improve the outcomes of the system as a whole. After all, incremental wins will compound greatly over time if they are sustainable. What may seem minuscule or insignificant in the ‘now’ may matter greatly in the future:

- What if I read 10 pages of a book every day for a year? If the average book I read is 300 pages, I’ll read 12 books by the end of the year. Double it to 20 pages a day, and I’ll read two books a month and 24 per year.

- What happens if I invest an extra $100 every month over 20 years at a 7% return? My $24,000 investment will compound and double to more than $50,000.

- What if I start a business and earn self-employment income on top of the income from my job? I can open a SEP IRA for myself and contribute more pre-tax income than someone who doesn’t have any self-employment income.

- What if I cut down on social media and TV consumption and instead reroute that time toward building my business? If that’s an hour a day, that’s an extra 365 hours per year–the equivalent of about 45 business days. But I need to give myself flexibility and grace to help relax & recharge as needed and avoid burnout.

These are things that are sustainable, repeatable, and most importantly, can compound. Once you’ve mastered the big wins, search for the little wins that will improve your outcomes and ultimately help you secure more happiness and satisfaction in life.