Your portfolio dividend income will give you a better raise than your job will, by percentage. And the results aren’t even close. You’ll almost always earn significantly more as an owner of companies than you ever will as an employee.

In this blog post, I’ll take a deep dive into the data and prove why your portfolio dividend income will almost always give you a better raise than your boss will.

To research and write this blog post, I compiled data from the Bureau of Labor Statistics, the Social Security Administration, Seeking Alpha, Google Finance, and Nasdaq, among other sources, and used it to generate all charts and carry out my calculations.

Experiment Assumptions & Data

Assumptions for the experiment (click to expand)

This article uses data from the Vanguard Total Market Index (VTI), my favorite equity ETF for easy and cheap diversification. If you have other equity allocations in your portfolio or bonds, your real returns against this time period will vary.

Since dividends usually come from more mature companies that are less likely to retain earnings to invest in more aggressive growth, you can expect even more dividend income from dividend ETFs like VYM compared to VTI which has a greater weighting and strategic focus on capital appreciation and growth.

Where applicable, charts and calculations will show values adjusted for inflation.

CAGR (Compound Annual Growth Rate) represents the mean annual growth rate over a period of time. It helps smooth out the annual rate of growth and mitigates the effects of volatility. Where applicable, we will use CAGR to smooth out results and annual growth metrics for the time series.

The time period and reference data for this experiment is 2002-2023, 21 years, which includes the 2007-2008 financial crisis, a roaring bull market, and the rise and fall (and rise) of the market pre and post-Covid. It was significantly more complex to dig up all of the specific historic data needed for analysis on VTI beyond this time period so we went with a more condensed data set.

As always, past performance is no guarantee of future performance, but data helps us make the best decisions we can heading into the future.

You can access the Google Sheet with my tables and charts here. Save a copy if you’d like to play around with the data!

The Average Joe Experiment – VTI Dividends VS Employer Raises

Average Joe is average in every way imaginable.

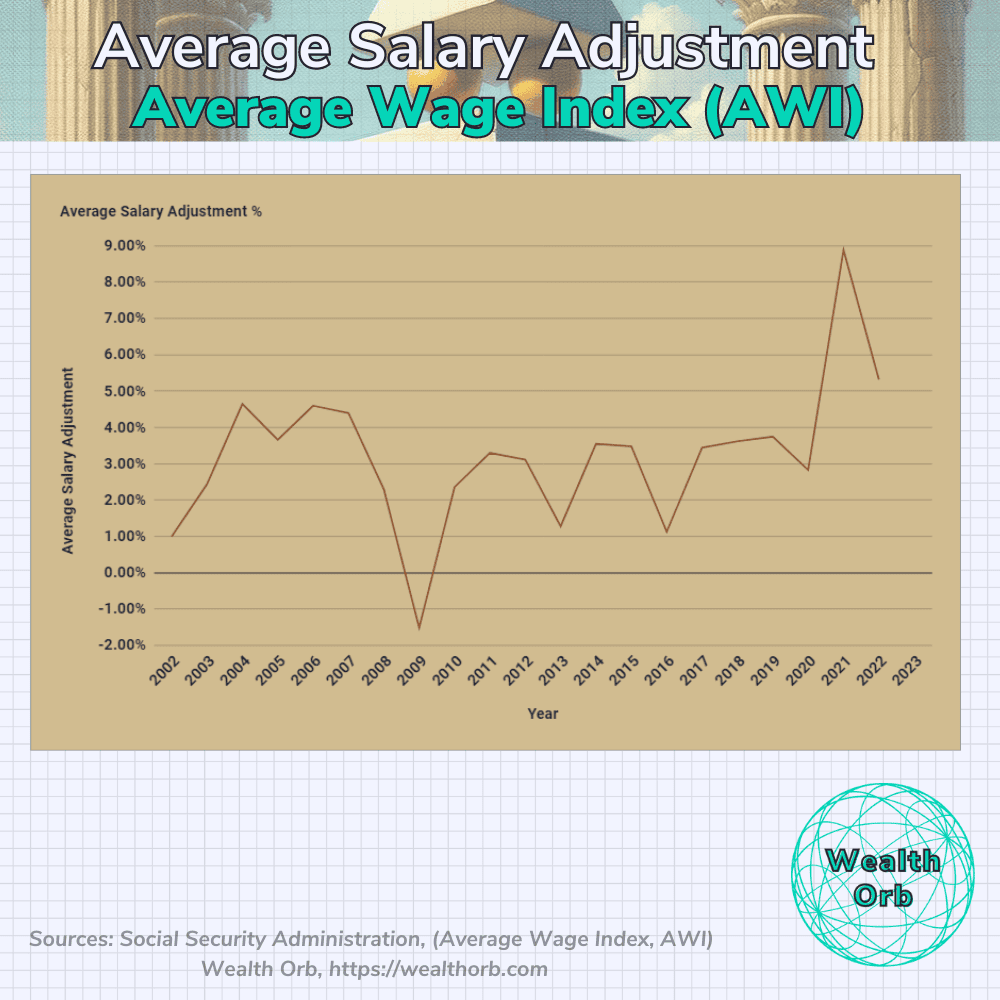

At his job, he has the magical knack of always earning a perfectly average annual salary adjustment (miraculously in line with the Social Security Administration’s record salary adjustments for all industries, aggregated).

He also holds an investment portfolio consisting only of the Vanguard Total Market Index (VTI). So his investment returns and dividends will be perfectly attuned to VTI.

Average Joe began his career in 2002 and after finalizing all of his data from 2023, wants to look back on how his dividend income has changed from his VTI holdings and compare it to the salary adjustments he’s received from his job.

He also wants to understand the impact of inflation on some of the core metrics.

Let’s help Average Joe understand his data!

Joe’s salary over time with raises

Unadjusted for inflation, over the 21 years from 2002-2023, Joe’s salary increased by 67.62%. On average, he receives a 3.22% salary adjustment every year of his employment.

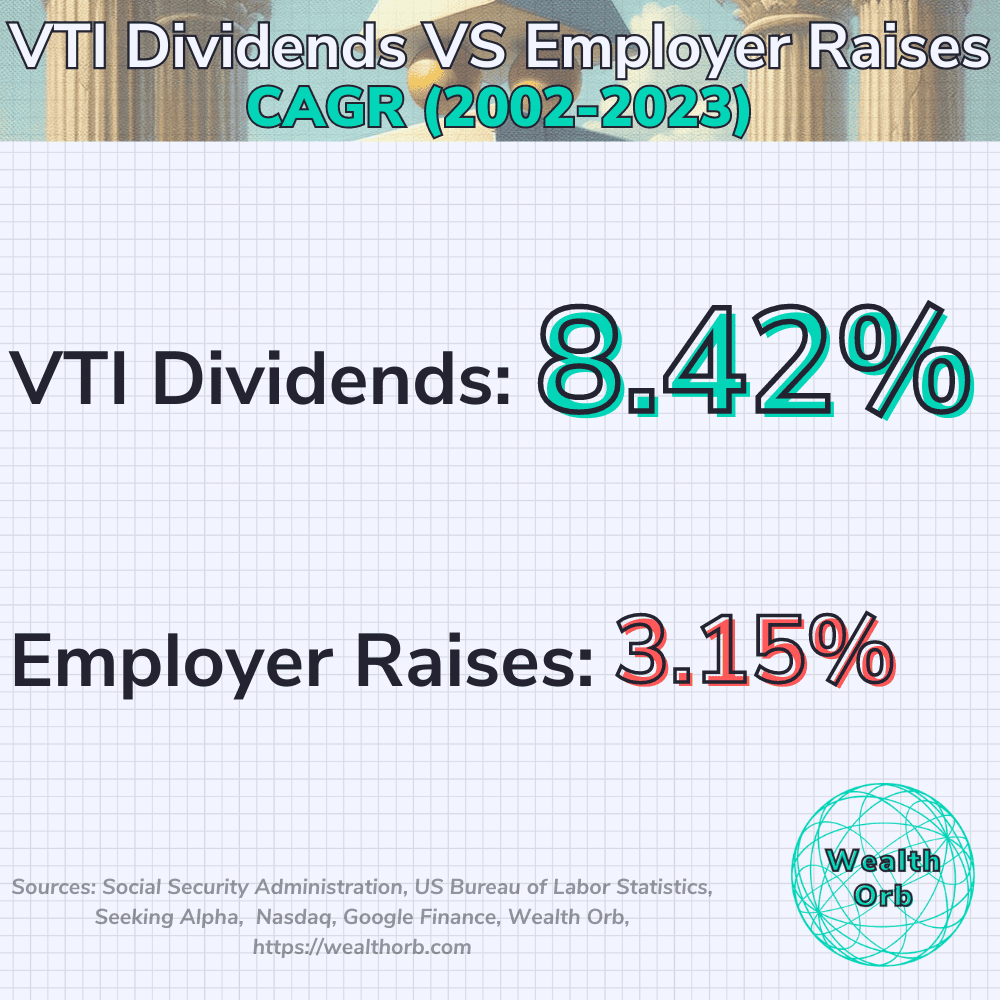

Smoothed out with CAGR (Compound Annual Growth), the figure is 3.15% annually.

With the exception of 2009 (a very challenging time for the economy), Joe earned a salary increase every year of his employment.

Joe’s VTI dividend income over time

As he earns income from his job, Joe invests a portion of it in the total market index (VTI). He is still working, so capital appreciation is more important than dividend income, but he still wants to understand how much of a raise his portfolio is paying him in dividends each year.

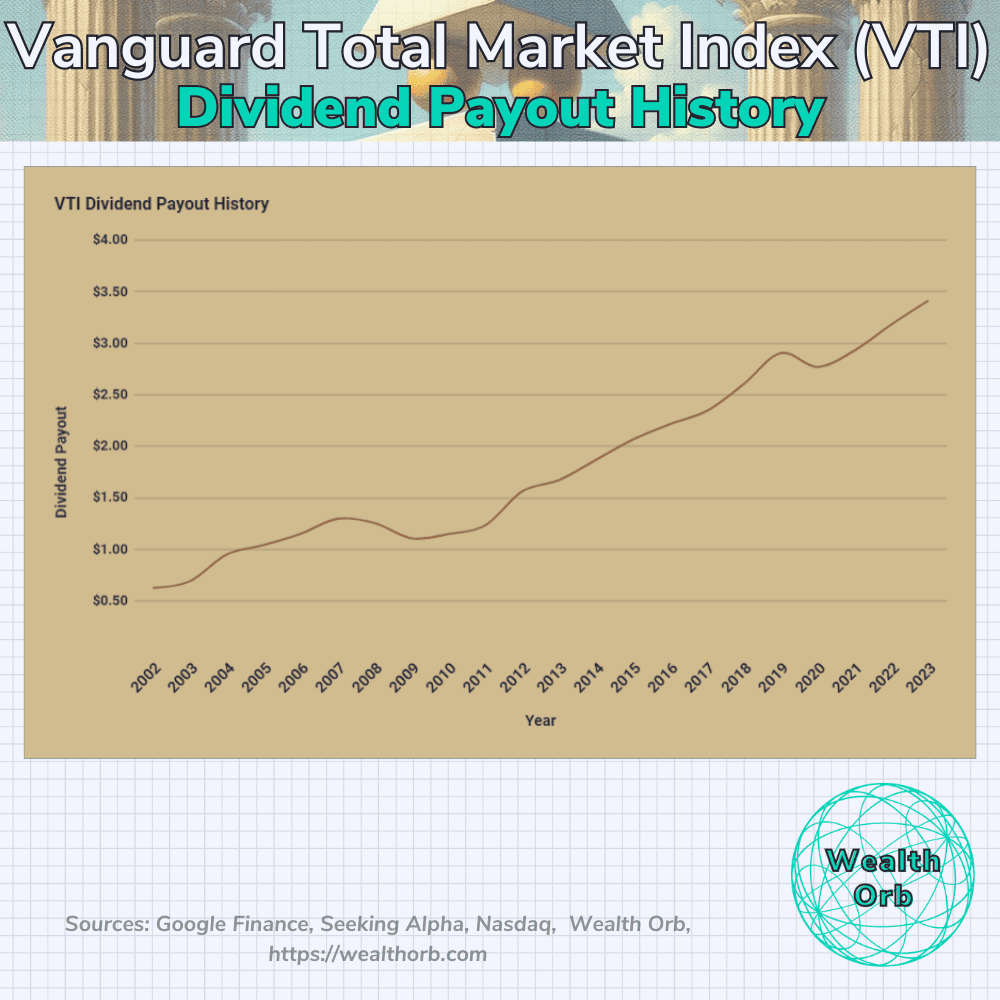

From 2002-2023, here’s how Joe’s dividends changed over time:

Nice trendline.

Up and to the right.

That’s what we like to see!

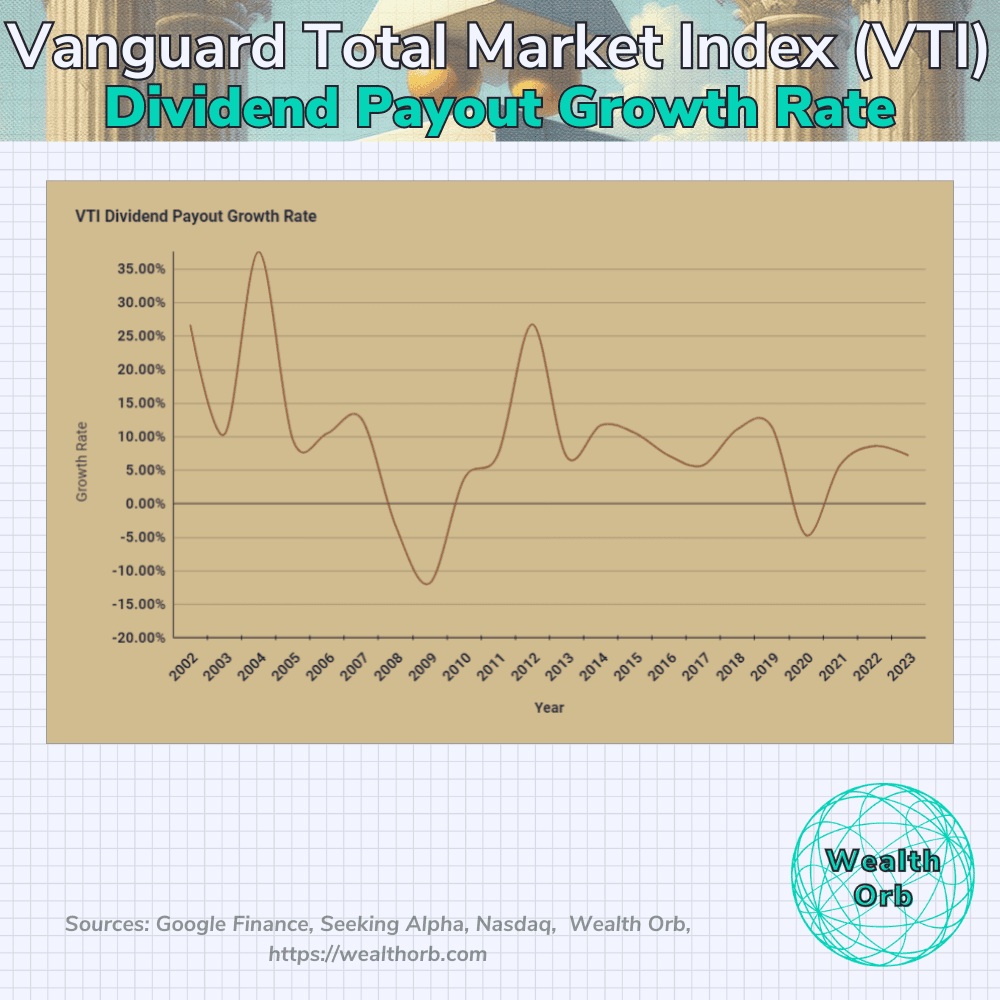

Looking specifically at the dividend payout growth rate, Joe’s dividend income payouts from VTI grew at an average of 9.35% per year from 2002 to 2023.

Smoothed out with CAGR, that figure is 8.42%.

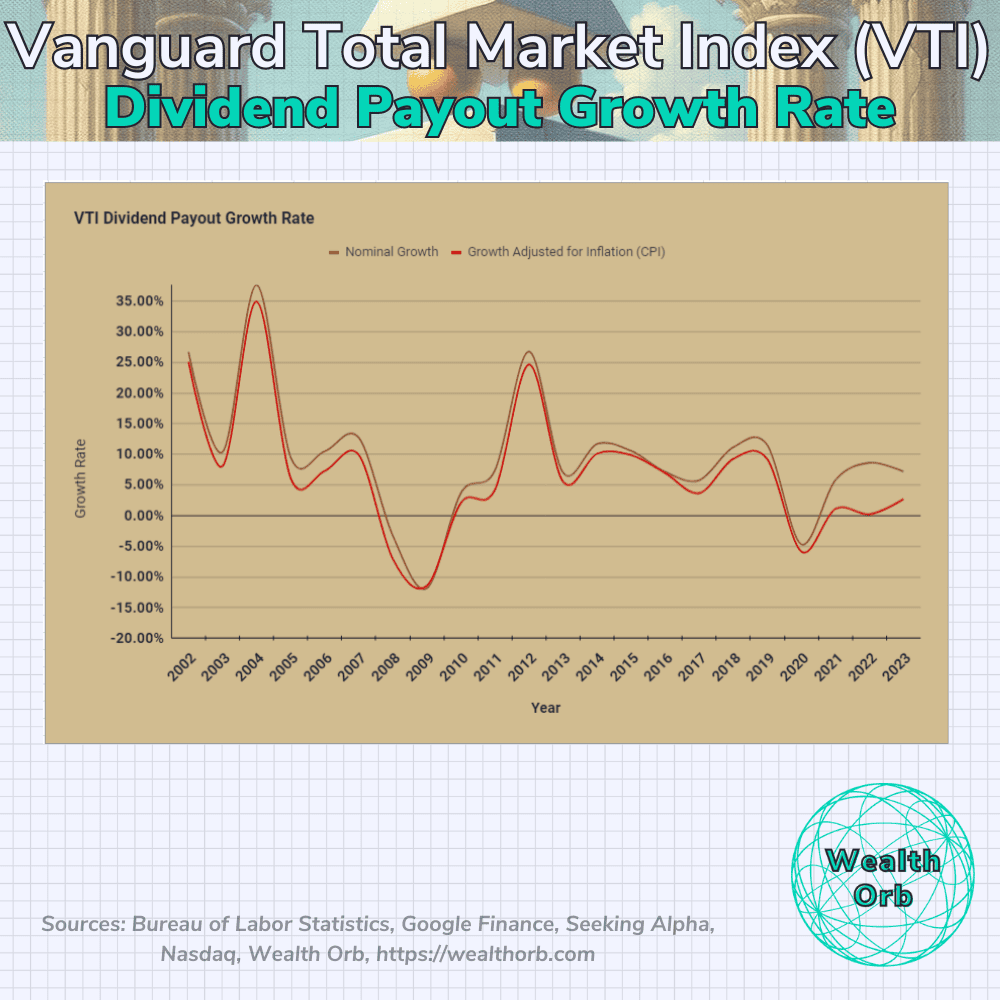

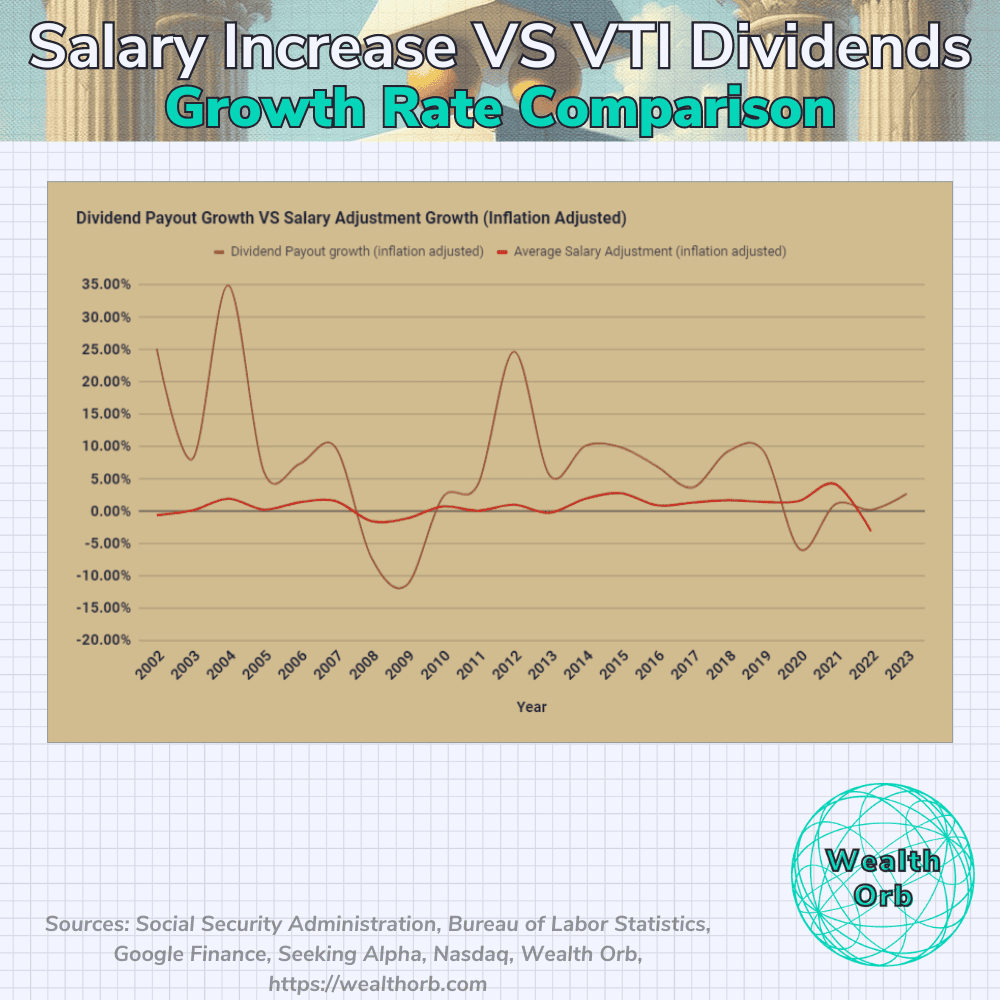

By pulling in CPI data from the Bureau of Labor Statistics, we can track Joe’s nominal dividend income growth, and that growth on an inflation-adjusted basis. The graphs track very closely, with the exception of 2021 onward, a period of abnormally large inflation, creating an inverse relationship.

Putting it all together Joe’s salary adjustments VS VTI Dividends: which raise is better?

Here’s where the magic happens.

We can adjust for inflation, and compare the average growth rate of Joe’s VTI Dividends with the income adjustments he receives from his boss.

Joe’s real (inflation-adjusted) increase in dividend income from VTI outpaced the growth rate of his annual salary increases in 17 of the 21 years. While this is admittedly a small sample size, it does give a good indication of how much VTI outperformed his salary adjustments at work.

Specifically, we can see that Joe’s dividend income growth rate only underperformed the increases from his salary at work in years of dire market conditions. The financial crisis of 2007-2008 and starting in 2020 with Covid.

For this time period, if the market was doing well, Joe’s VTI dividend growth was outperforming his salary increases from work by a significant margin.

Assuming you were to drop all 21 outcomes in a bag and draw a random one, Joe had an 81% chance of his dividend income growth outpacing his salary growth at work for any given year.

Comparing both CAGR figures solidifies this realization even further.

Smoothed with CAGR, Joe experienced over DOUBLE the growth rate on his dividend income from VTI than his salary increases from work.

A 167% increase in fact.

The power of dividends in wealth-building

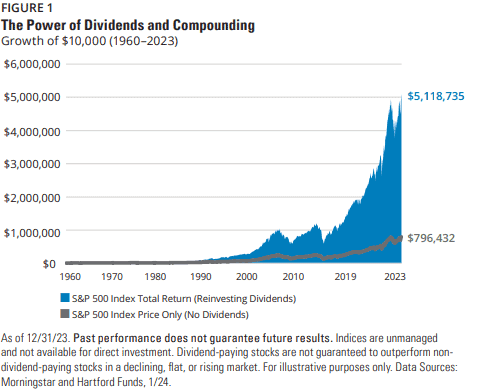

In a long-term study from Hartford Funds, the data shows that “Dividends have played a significant role in the returns investors have received during the last several decades. Going back to 1960, 85% of the cumulative total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding.”

The data alone tells us that reinvesting all dividends in the market is an 80/20 method to improve investing outcomes.

Reinvesting your *growing* dividends from your stock holdings will help you build considerable wealth over a long period. You’ll also acquire more shares. Most ETFs, like VTI, pay out a quarterly dividend that you can automatically reinvest in your portfolio.

Most brokerage and retirement accounts include DRIP (Dividend Reinvestment Program) that allows you to reinvest your dividends in fractional shares.

Set it and forget it!

The other benefit of dividend income from VTI

If you don’t already, you’re about to hate your earned income from work.

For long-term holders, VTI dividends are classified as qualified dividends. If you are in the 22-35% income bracket, you will only pay 15% of the qualified dividends in taxes. As compared to the full amount of your top-line bracket for earning an additional dollar of income for the year.

The rich earn more from their investments than their work and enjoy much lower tax rates because of it.

Think like the rich and use your income to become an owner!

It’s easier to retain wealth when your dividend income growth beats out salary increases and are taxed less.

This all looks great for Joe! I guess I don’t ever need another raise at work, right?

Not so fast!

The dividend growth percentage for VTI has been great for the last 21 years. It’s hard to refute that.

But this data alone doesn’t tell the whole story.

VTI dividends, while growing much faster than wages every year, still only reflect a tiny percentage of share value.

In 2012, VTI paid out 2.61% of share value in dividends to shareholders throughout the year.

And in the same year, employee salaries increased by 3.12%. Of my data set and time range, this is the closest the actual percent yield of VTI gets to the percent increase in employee salary.

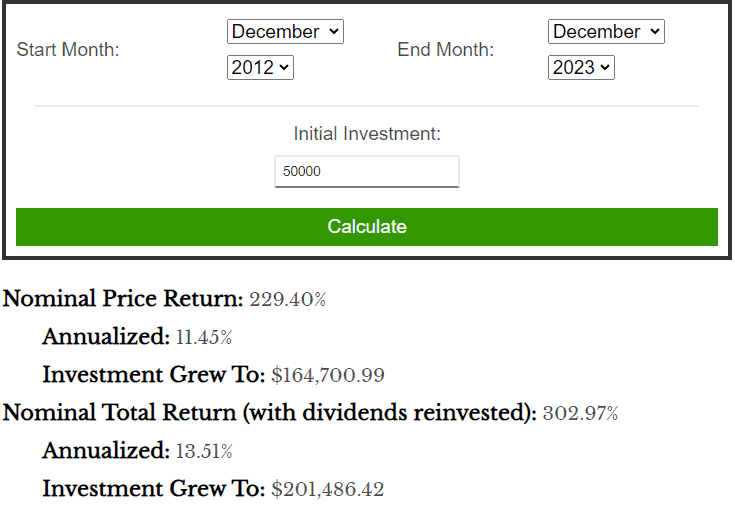

To compare the two, we’ll assume that Joe earned a $50,000 salary heading into 2012, and also had a $50,000 investment in VTI.

Let’s compare a $50,000 pre-tax salary receiving the 3.12% pay increase, to the 2.61% yield of VTI on a $50,000 investment.

With his 3.12% increase in salary, Joe will earn $1,560 more per year pre-tax. Bringing his total salary to $51,560.

At a 2.61% yield on his $50k of VTI, Joe will earn $1,305 in dividends.

To match his raise at work and earn the same additional income from his VTI holdings, Joe would need to hold $59,770.11 in VTI.

In 2012, the market experienced incredible growth

2012 was also a GREAT year for the market and VTI.

VTI’s dividend payout growth percentage increased by 26.76%, or 24.66% after adjusting for inflation that year.

Since we know the CAGR for dividend payout growth over the entire timeline of 21 years is 8.42%, that means even with a stellar year of dividend payout growth for Joe’s VTI holdings, of almost 3x the CAGR, the actual percent yield on his VTI investment was still lower than the increase in percent to his salary.

This is comparing apples to oranges, somewhat. The point is it takes a lot of capital to generate dividend income that will beat salary raises dollar for dollar.

Especially when you are early in your career.

This is even more true the higher your salary. You have more potential to invest since less of your income is going to essentials for survival.

The calculus shifts significantly to the other extreme of the spectrum the longer you have been investing.

Joe’s VTI dividends on a $50k portfolio missed the actual dollar figure of his raise from work on his $50k salary by almost 20% in 2012.

Taking a look at the data in 2024

Today, in 2024, VTI’s dividend yield is even lower, clocking in at 1.31% at the time of writing, despite actual dividend yield payout growth continuing to increase.

Flash forward to 2024. Joe’s $51,560 salary has grown to $72,291.10 before his 2024 raise. His 3.12% salary increase on his base salary of $72,291.10 improved his income by $2,255.49 and brought him to $74,546.59 in salary.

We know the dividend yield for VTI in 2024 is currently 1.31%, so to match the $2,255.49 in his employer raise in dividends dollar for dollar, Joe would need to hold $2,255.49/0.0131= $172,174.81 in VTI, more than DOUBLE his current salary.

But this wouldn’t have been a problem for Joe.

Remember that in 2012, he had $50,000 invested in VTI. Even without an additional cent invested in the market, Joe’s investment from 2012 to 2023 would have grown significantly:

By reinvesting all of his dividends over this period and enjoying an incredible bull market, Joe’s $50,000 VTI holding in 2012 would be worth $201,486.42 heading into 2024, enough to generate $2,639.47 in dividend income for 2024 at current yields without any additional growth.

The longer you are invested, the more time your portfolio and dividends have to compound your wealth. And the less reliant you will be on your employer for cost-of-living raises.

Your portfolio will almost always give you a raise even when your employer will not.

Why raise still matters at work

Throughout this experiment, Joe had consistency and predictability on his side in a way that almost all of us did not.

In an empirical environment, there is much outside of our control that Joe did not have to deal with in his theoretical and controlled environment.

Some years, you may not get a raise at all. In other years, you may receive more than the average raise, and that’s great!

Any year you do not receive any kind of cost-of-living salary adjustment at work, you are effectively being paid LESS to do your job due to inflation eroding your spending power. At a minimum, you should look to receive a cost of living increase to maintain your quality of life.

If it’s been more than a year without any kind of cost-of-living increase, it’s probably time for a conversation. Unless the market or your company is really hurting and you are fearful about job security.

Your income is still incredibly valuable. During your working years, it is your best way to consistently invest more in the market.

Over time, you trade your human capital for financial capital, with the goal of having enough financial capital to allow you to retire.

By keeping your spending under control when you receive a raise:

Higher-income = more investing = more income from your investments.

More time in the market + reinvesting all your dividends = more compounding potential.

Simple enough.

Raises are still important, and they need to be discussed with your boss

You should be revisiting your compensation, researching the fair market value of your role, and trying to negotiate a raise about once per year. Not more frequently unless something considerably changes in your job description.

Even if your research shows you are paid competitively, talk to your boss about what it would take to be a top performer. Discuss how your compensation may change as a result.

To beat the point to death: to grow wealth over time, you need to consistently use your income to purchase income-generating assets.

This becomes easier to do with higher income, so long as you keep lifestyle inflation in check.

I wrote about some ideas that can help you and how to continue to build and improve the value of your human capital in this article on failing your way to better personal finances and this article on implementing micro-frameworks to build wealth.

Bad news isn’t all bad

So when you inevitably receive the bad news from your boss one year that you won’t be receiving a raise, try to find some solace in the fact that your portfolio will give you a raise instead!

And when you do receive a modest raise at work, use at least half of it to put toward your financial future and keep investing!

🟢 Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- The data shows you will consistently build more wealth as an owner than you ever will as an employee. Use your income from being an employee to become a partial owner of companies.

- Reinvest ALL dividends from your portfolio for long-term growth.

- Invest as much as you can, but don’t neglect the power of a raise at work. Your income will help you invest more over time if you keep lifestyle inflation in check.

- Invest before and after tax for greater flexibility and to achieve financial freedom faster.

- Support your investing goals with an ironclad budgeting strategy.

- Looking for cash to invest today? If you have a fully-funded emergency fund, it may be overfunded!

💬 Reader suggestions for discussion

- Did any of the data surprise you? How do you view your raises from work and from your portfolio?

- What strategies are you using to consistently invest more in the market over time?

- How do you use your raises at work to act on your financial goals?

Comments