If you have a fully-funded emergency fund, I can almost guarantee you have overfunded it. Even with today’s high rates and the ability to earn 5+% in risk-free interest from HYSAs, CDs, or treasury notes, historical market returns tell us we can do better with a total market investment, after adjusting for inflation. Historically, the best way to earn that return is to make a lump sum investment in the market. In today’s blog post, I’ll show you the simple reasons why your emergency fund has too much money and what to do about it.

Even if you don’t have a fully funded emergency fund yet, this article will show you why your cash target is likely too high.

Let’s dive in!

Why your fully-funded emergency fund has too much money in it

The same reason why we as mindful personal finance practitioners will likely never run out of money, is probably why you have too much money in your emergency fund. You are rational.

During the day, I work in IT consulting, specifically with Microsoft technologies in the cloud.

In almost every project we complete for customers, we need to rightsize the customer’s infrastructure configurations in Azure so they support whatever workload or application we deploy to the cloud without being under or over-provisioned. Not enough capacity, and workloads and applications will be sluggish, and not perform to spec, causing issues for the business.

Too much capacity or resources and customers will get an unpleasant and expensive cloud bill from Microsoft because their solution is burning too hot.

There’s gotta be a Goldilocks and porridge analogy to be found somewhere in here.

The reality is that we have more or less the same goal with our emergency funds in personal finance as I do in my consulting projects: to get the balance right and optimize the end result.

Not enough cash in the rainy day fund and we run the risk of being underprepared for an emergency and sluggish in our response in deploying enough cash to stop the bleeding and buy time to find a permanent solution. Too much cash in our fund and we miss out on potentially higher gains from purchasing more investments.

We want the porridge to be just right.

Traditional thinking, and a new approach

A traditional bellwether for a fully-funded emergency fund is three to six months of expenses, based on your average monthly spending. But if you are rational and budget on a monthly basis, you have a lot more flexibility than you might think.

PSA: if you’re not budgeting yet, it’s time to start and build an ironclad budget for life. Stop what you’re doing and go build a budget right now.

During financial hardship, we tend to worry if not outright panic about the situation. During a true financial hardship or emergency, you won’t be going to Starbucks for your morning coffee. You won’t be buying things you don’t need on Amazon. You’ll be canceling your extraneous streaming subscriptions, cutting back on visits to restaurants and bars, axing that trip to the to buy a pack of brewskis and selling your concert tickets.

You’ll do what it takes to survive and come out on the other side in one piece.

The reality is that most budgets (healthy ones at least) have flexibility built in for discretionary purchases that you get to choose how to allocate on a monthly basis.

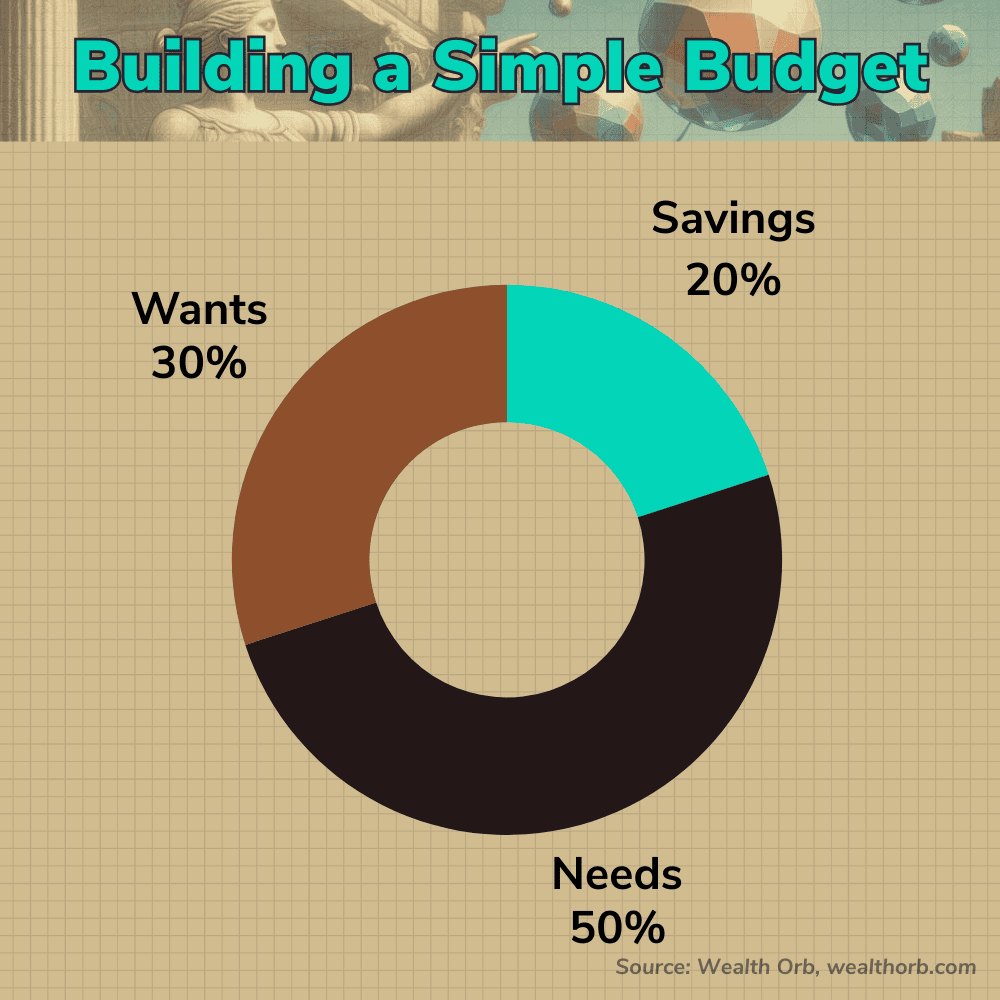

With the popular 50/30/20 budget, for example, you have an entire 20% of your paycheck that goes toward these type of purchases that can be scaled back during times of hardship.

The Wealth Orb approach to rightsizing an emergency fund

I can’t stress it enough. You do NOT have the data you need to rightsize an emergency fund without knowing exactly where each dollar of your income is going. Period. Don’t make any changes to an emergency fund without knowing this!

We’ll use the popular 50/30/20 budget as the baseline for rightsizing an emergency fund. 50% Needs, 30% Wants, 20% Savings and debt repayment. If you use a different budgeting system, no worries. Simply tweak the percentages as needed to represent your budgeting system.

For this example, we’ll assume your family spends $6,000/month on average, including your savings and debt service.

50% Needs: $3,000.

30% Wants: $1,800.

20% Savings: $1,200.

Your fully funded emergency fund in this scenario using a traditional approach and six month emergency fund is $6,000 * 6 = $36,000.

Want your own numbers? Plug your net monthly income into my calculator above!

Let’s assume you can easily stop, cancel, or otherwise pause at least half of your expenses in the ‘Wants’ category at a moment’s notice, with a few support calls thrown into the mix. That’s 10% of your total net income in expenses that disappear into thin air like a hat trick. If you’re able to take it even further, you may even approach the asymptote of eliminating all 20% of your ‘Wants’ category by going into survival mode.

Some examples of cuts in the ‘Wants’ category:

- Beer money

- Sweet treats

- Coffee runs

- Streaming subscriptions

- Amazon purchases

- Concert tickets

- Out to eat and bars

Savings by cutting ‘Wants’ in half: $900. Eliminate all your ‘Wants’, and you’ll save an extra $1,800/month in this scenario. This category is the low-hanging fruit. You’ll get the most mileage in cutting expenses by starting with discretionary purchases.

Even in the ‘Needs’ category of most budgets, there’s some flexibility in spending. Let’s assume you can cut about 10% of expenses here since it’s a lot harder to do in this category.

Some examples of cuts in the Needs category:

- Expensive groceries and grocery stores (yes, you can eat healthy and cheaper)

- Pausing gym memberships in favor of working out at home

- Reducing water and electricity usage as much as possible (run the AC a little hotter or the heater a little colder)

- Downgrade your internet or phone plan temporarily

- Try to drive your car less, at least temporarily

Savings by saving 10% on your ‘Needs’ Category: $300/month.

Lastly, in the Savings category, I’m going to assume every penny post-tax is going toward replenishing your emergency fund. Do everything you can to not touch your pre-tax contributions to the 401k & HSA if possible, but pull this level in a dire emergency. We won’t make any adjustments here for calculations.

If you’re more conservative, cut your potential savings in the lower band of the categories above in half.

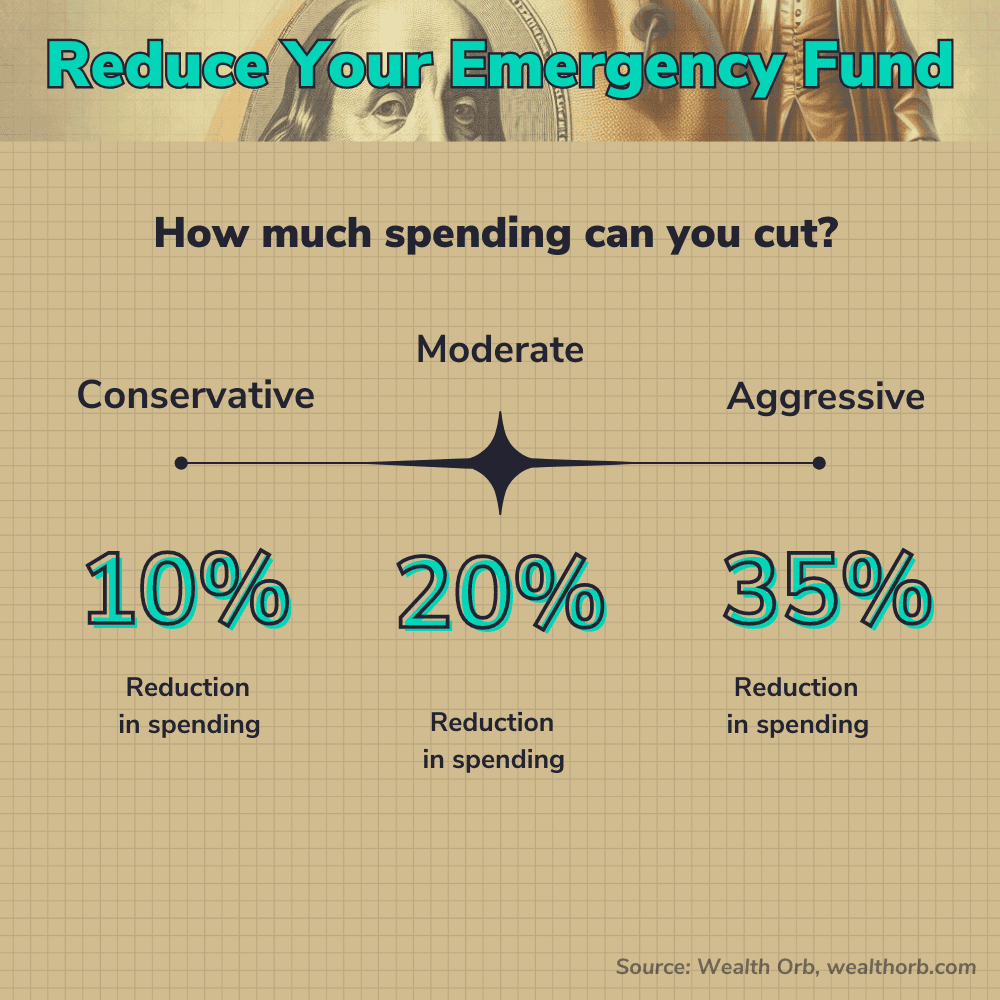

You can comfortably save an extra $600/month, 10% of your monthly spending by conservatively cutting expenses and assuming your cost-saving countermeasures won’t be as effective as you think, $1200/month, 20% of your monthly spending in a real financial emergency, and maybe even closer to $2,100 or 35%+ with some extreme willpower and a can-do attitude.

Putting it all together

In the example above, you can assume that a rightsized and fully funded emergency fund for your family is 10% less on the conservative side, 20% less on the moderate side, and 35% less on the aggressive side than traditional financial wisdom would have you believe.

Default emergency fund: $6,000 * 6 = $36,000

Rightsized emergency funds

Conservative, 10% less: ($6,000 * 6) * 0.90 = $32,400

Moderate, 20% less: ($6,000* 6) * 0.80 = $28,800

Aggressive, 35% less: ($6,000* 6) * 0.65 = $23,400

You can reduce your fully funded emergency fund by $3,600, (10% conservative) to $7,200 (20% moderate) to $12,600 (35% aggressive) and likely be just fine, even in an emergency, knowing that you can and absolutely will make cuts to your average monthly spending when faced with hardship.

The other lever we haven’t explored is earning more income.

Anything you can do to try to increase earnings during a hardship can give you more fuel to add to your escape trajectory and replenish your emergency fund.

Pick up extra shifts at work, negotiate a raise, pick up some shifts on Uber or Doordash, put time into your side hustle, or sell things you don’t need online.

There’s almost always a way to find a few extra dollars in a pinch.

Adjust the model and make it yours

Different people in different life situations have different levels of risk tolerance for different reasons due to different circumstances.

What is mathematically optimal may not be what’s correct for you.

See where this is going?

So how much cash should you have in your emergency fund? The standard and almost always correct answer we give in consulting is “It depends.”

If you plug in your budget numbers and followed along with the article and you’re looking at the 20% reduction to your emergency fund needs and are thinking it isn’t comfortable, that’s fine! Does 10% look better?

Review, understand, and prove out the experiment with your data

Take it a step further and go through your financial reporting, go through your last month and comb through the expenses that you could have realistically cut. Sum them all up and divide by your total spending for the month. This is your percentage of total savings from cutting expenses. Then look and see which of your expenses could have been reduced if an outright elimination isn’t possible. This empirical experiment will show you what you can save and help you prove to yourself that you need less cash than you think in your emergency fund.

You should be comfortable with the figure and the change you are making in your finances.

There’s immense value to financial peace of mind, and I’d much rather you be comfortable with your emergency fund balance than chase a potentially higher yield with risk assets when you’re already making good financial decisions. Having an emergency fund is a good financial decision. Budgeting is a good financial decision.

If you’re comfortable with your emergency fund as is, you don’t need to change it. If you’re comfortable earning high-interest risk-free on your emergency fund and holding extra cash, that’s perfectly fine!

I’m just planting the seed if scooping up more risk assets for long-term growth is compelling to you and your circumstances, then it’s possible and rational.

I lean on the more conservative/moderate side with emergency fund reduction. I have a young daughter (15 months old) at home. I’m also happy earning over 5% of risk-free income from my emergency fund and having more peace of mind for my family.

Where to put your excess emergency cash today

After taking the time to review our expenses and truly reflect, we reduced our family’s emergency fund in 2024 by 20% and used that money to max out my traditional IRA for the year and make some contributions to our daughter’s 529 and our brokerage account. We are ineligible for Roth contributions.

If you haven’t maxed out your post-tax IRA (Traditional or Roth depending on your income), this is an excellent place to start when reducing your fully funded emergency fund. This account should be prioritized before going all in on your brokerage account and making additional investments there. After this is maxed, a 529 or brokerage is an excellent place to purchase more risk assets next.

Another place to look to deploy your cash immediately is paying off debt. The amazing thing about paying off fixed-APR debt is earning a GUARANTEED return on your dollars. You also don’t pay taxes on that return. Double win!

If you’re investing in risk assets, I’m a big fan of ultra-low-cost total market or S&P 500 indexes like VTI and VOO. Buy it, keep buying it, and forget it until it is time to decumulate assets and enjoy all your hard-earned wealth.

🟢 Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- You likely can comfortably and safely reduce your fully-funded emergency fund. Do the math and prove what you can save on your monthly expenses.

- Make sure you are already budgeting and are familiar with your personal budget before making any changes to your emergency fund. You NEED the data to make an informed decision!

- It’s perfectly fine not to reduce your emergency fund to buy more risk assets, earning 5+% risk-free on cash is very nice.

- Invest your excess cash! The whole point of this exercise is to open an opportunity to invest more for your future with a buy-and-hold mentality.

- Reevaluate and adjust your emergency fund over time. As a best practice, it’s best to reevaluate your family’s emergency fund needs once a year. Circumstances change, and inflation is real. What worked last year may not work this year. Use your data to reevaluate!

💬 Reader suggestions for discussion

How have you structured your emergency fund?

What changes can you make to your fully funded emergency fund or target number?

What are some of your favorite savings hacks to cut on spending and save more money?

How will you use your newfound pile of cash to advance your financial goals?

Comments