Budgeting is essential to good personal finance. It doesn’t matter how much money you earn—everyone needs a budget. Without visibility into where every dollar you spend is going, you can’t make informed, data-driven decisions with your finances. In today’s post, I’ll show you two different options for a great budget and exactly what to do to build a proven, ironclad budget that can withstand some of the most challenging financial storms that life can throw.

Why you need to track your expenses and stick to a budget

Before building any budget, we have to track every dollar and where it’s going. The more data you can collect to analyze, the better you will understand your spending trends and where you can look to make improvements or adjustments over time.

It doesn’t matter how much money you earn—everyone needs a budget and accountability for it.

In 2003, Mike Tyson famously went bankrupt, owing over $23M in debt despite taking home over $400M of career earnings. Tyson was reportedly spending over $400k/month to maintain his lavish lifestyle, owned multiple homes, and even purchased a $2.2M 24K-gold bathtub for his wife as a gift.

If someone earning $400M needs a budget to avoid financial ruin, so do we.

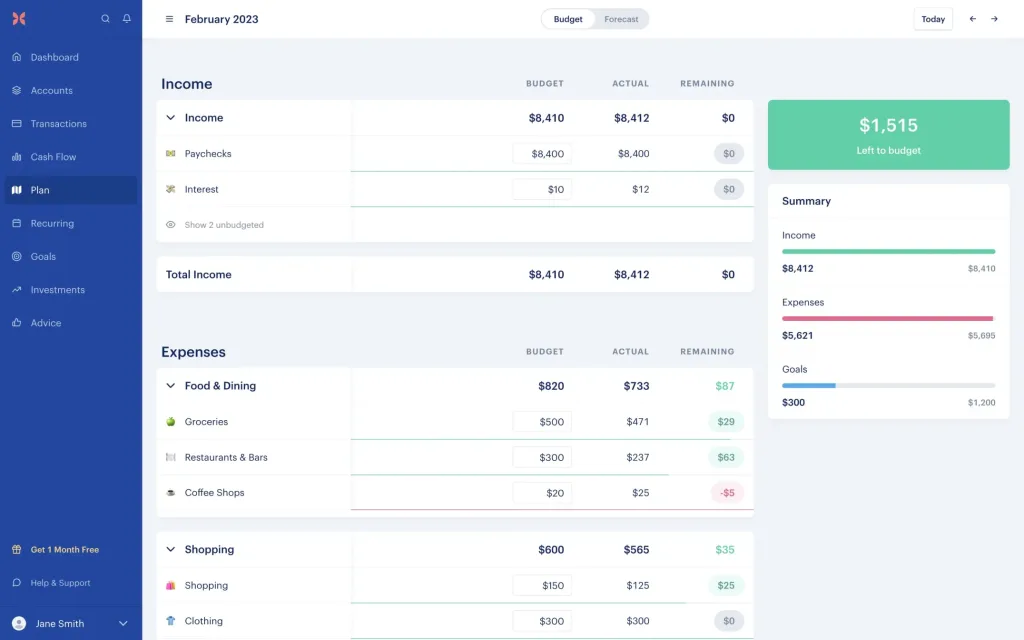

The best budgeting software in 2024

Thankfully, in 2024 it’s easier to budget than ever before. Gone are the days of manual spreadsheet or pen & paper budget tracking. With a little bit of legwork and a trusted application, budgeting can be simple once you set up the automation and connect all your financial accounts. You can get a single pane of glass view into your finances and a snapshot at how you’re performing during the month.

For the best budgeting software, I highly recommend Monarch, a powerful spiritual successor to Mint.

Monarch makes it simple to track your expenses by category, see how much income you’ve pulled in for the month, and how you are allocating savings toward financial goals like retirement, saving up for a home, or a dream vacation. The sky is the limit and in 6 months of personal use, I’ve fallen in love with Monarch. One of the best features is the ability to add additional household members to your dashboard for better collaboration.

Help support the blog and get a 30-day free trial and 50% off your first-year subscription with my link.

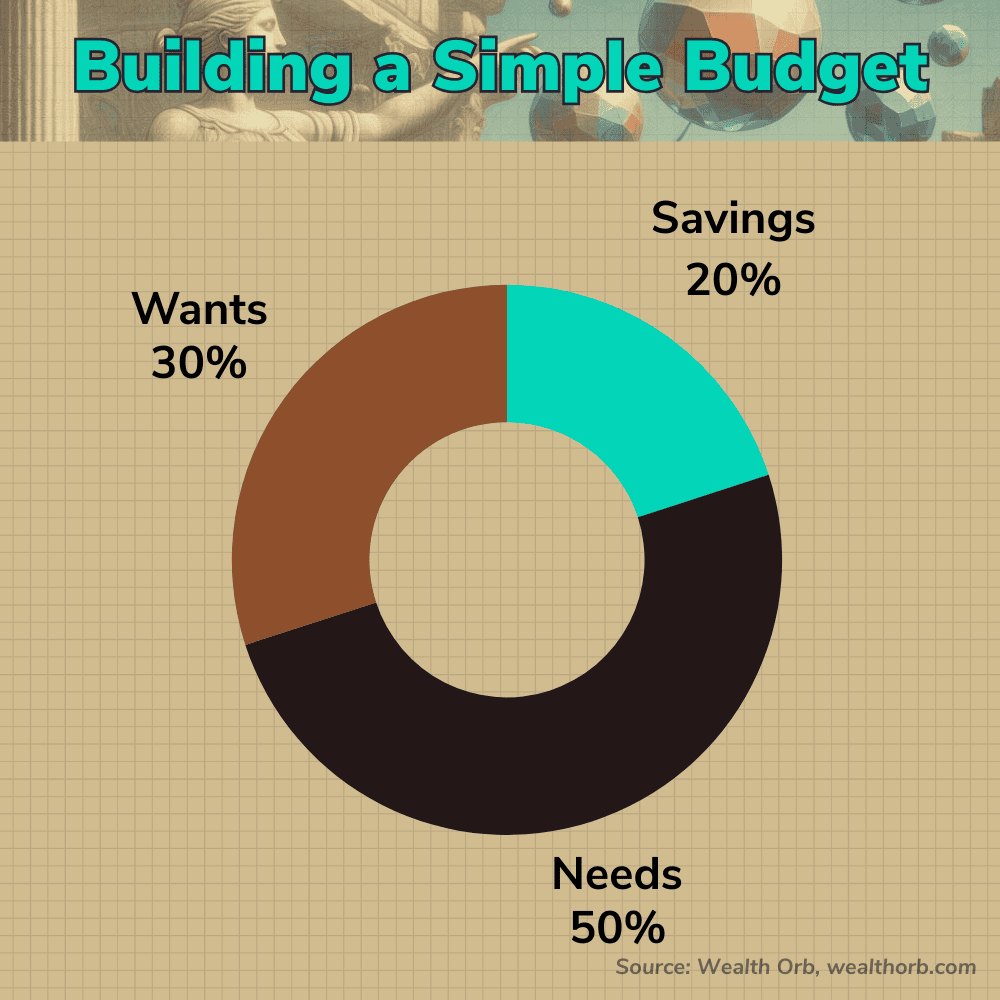

Starting out: the simple 50/30/20 budget

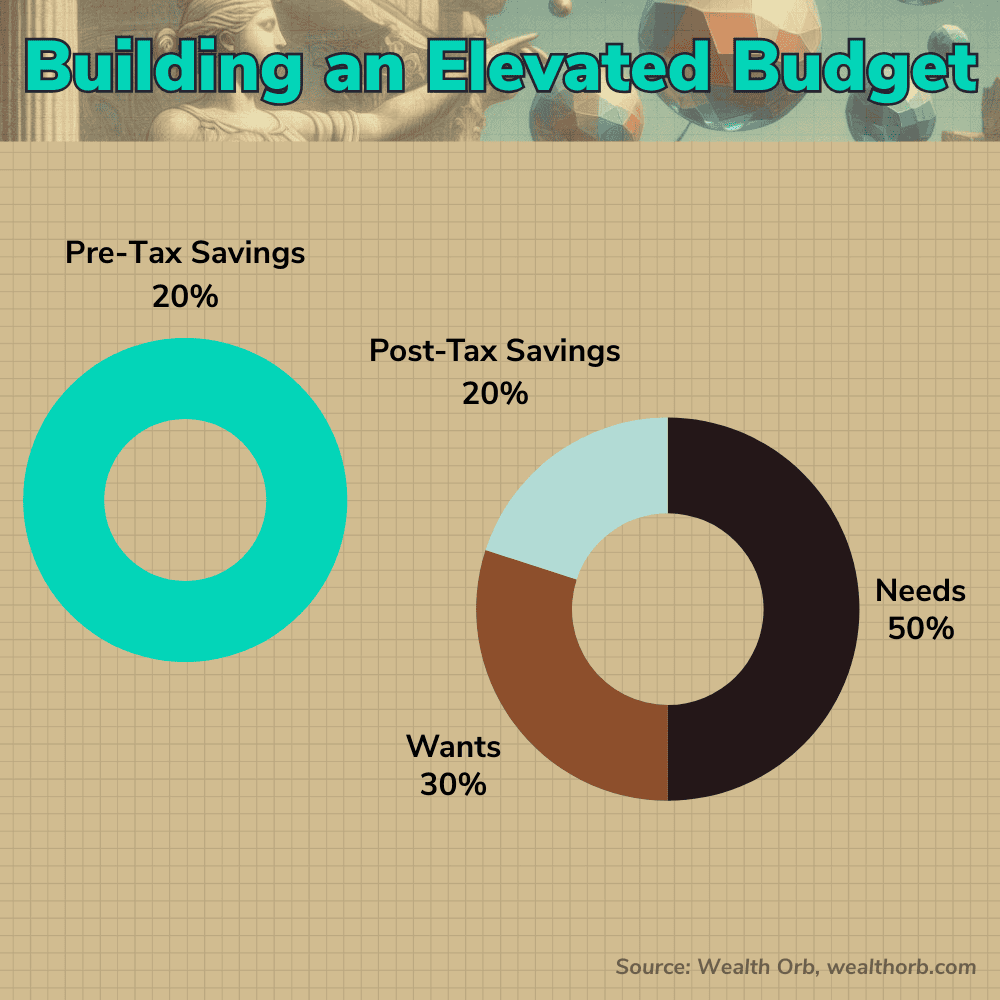

The tried and true 50/30/20 budget is an excellent starting point for anyone new to budgeting. For the most part, it helps you live within your means, but also provides plenty of flexibility for fun along the way. When done well, the 50/30/20 budget can help you budget, without feeling like you’re making as many sacrifices along the way.

In fact, you can’t really go wrong with this approach and in most cases, it should be sufficient to help protect against financial hardship and ruin. With this budget, you’ll track your net income (after-tax take-home pay) and split it into three simple buckets. Needs, Wants, and Savings (+ debt repayment).

Who the 50/30/20 budget works well for:

- People who don’t like budgeting.

- People who have a mix of short and long-term financial goals.

- People who want to improve their personal finances.

- People who still want flexibility in their budget to have fun and make plenty of discretionary purchases.

- People who want to become financially independent and retire at or little before traditional retirement age.

No more than 50% of your budget should go to needs—the things that you have to have in order to live.

- Housing (rent or mortgage) & basic maintenance and repairs

- Food (basic, healthy groceries to meet caloric and nutritional needs)

- Transportation (safe car or public transportation to get from point A>B, nothing flashy)

- Basic utilities

- Insurance

- Medical care

- Minimum debt payments

- childcare

Exceed 50% in this category, and you won’t have a lot of flexibility in your finances. This can put you at risk for overspending and feeling ‘trapped’ in trying to maintain a lifestyle that is realistically above your means.

Up to 30% of your budget should go to your wants—the things you want but don’t need in order to survive.

- Entertainment and subscriptions

- Coffee shops & out to eat

- Travel and vacations

- Housekeeping or landscaping

- Shopping, sweet treats, amazon, etc

20%+ of your budget should go to savings and debt repayment—this is where you work on your financial goals and work to improve your finances.

- Contribute to 401(k), HSA or alternative retirement plans through work

- Investing in a brokerage account

- Start or build an emergency rainy-day fund (bonus points for putting your money in a HYSA)

- Work toward financial goals like buying a car, or buying your first home

- Repay debt

Pro tip: With any bad debt (I define bad debt as debt exceeding 8% APR), I would advocate for significantly cutting the ‘wants’ category until you eliminate the debt. Carrying bad debt will erode any progress that you are trying to make to improve your finances and escaping that debt should be prioritized above almost everything else.

Want to understand what this budget looks like for your situation? Plug in your monthly net income: your income minus taxes into the calculator I made below. Do not include any deductions like 401k or HSA contributions in this calculation. If you’re unsure, you can get your numbers from your paystub or HR software.

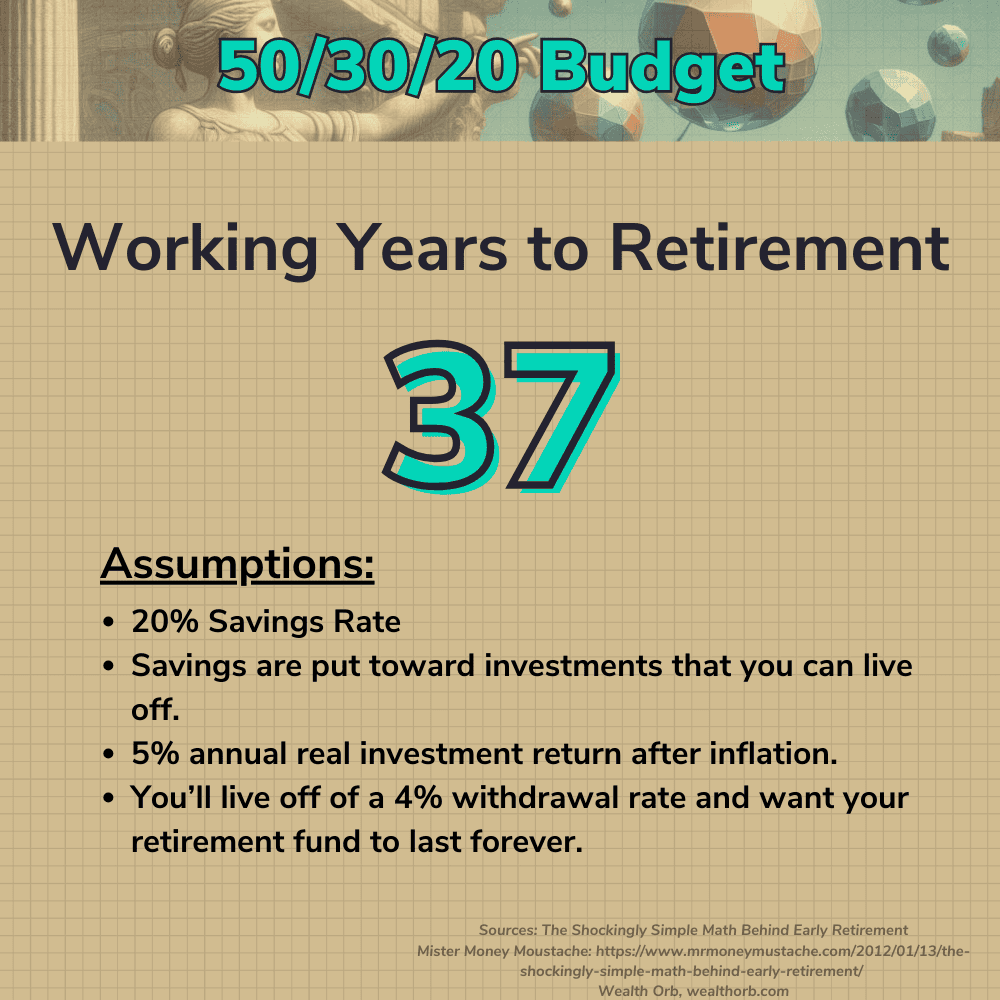

How long will it take to become financially independent and retire with the 50/30/20 budget?

One of Mr. Money Moustache’s most popular blog posts, The Shockingly Simple Math Behind Early Retirement, gives a good glance at how long it will realistically take to retire with a 50/30/20 budget, assuming that all of the 20% is put toward investments that you can live off. With some simple modeling, it will take roughly 37 years to retire with this budgeting approach. Not bad, but we can do much better.

The Wealth Orb Elevated Budget

I’m not going to lie or sugarcoat it. This budgeting system is much harder to maintain and succeed at long term. It requires you to live beneath your means, never carry bad debt, and continue to work toward both long and short-term financial goals. This is the budgeting protocol my family uses as we strive toward financial independence. While it isn’t always easy, it is extremely effective and has helped us make significant strives in building long-term, lasting wealth.

This budget approach will feel like you are cutting and making sacrifices to maintain this level of budgeting discipline, but this approach will help propel you to financial independence quickly. Admittedly, this budget may not work for all levels of income. You can only cut expenses so far, so if you are in a lower earning position or early into your career, it may be more challenging to hit these thresholds. Ease into it, and adjust as needed for your situation. If your goal is also to max out pre-tax investment contributions, you may need to contribute more pre-tax and less post-tax. It’s okay to play with the values and percentages.

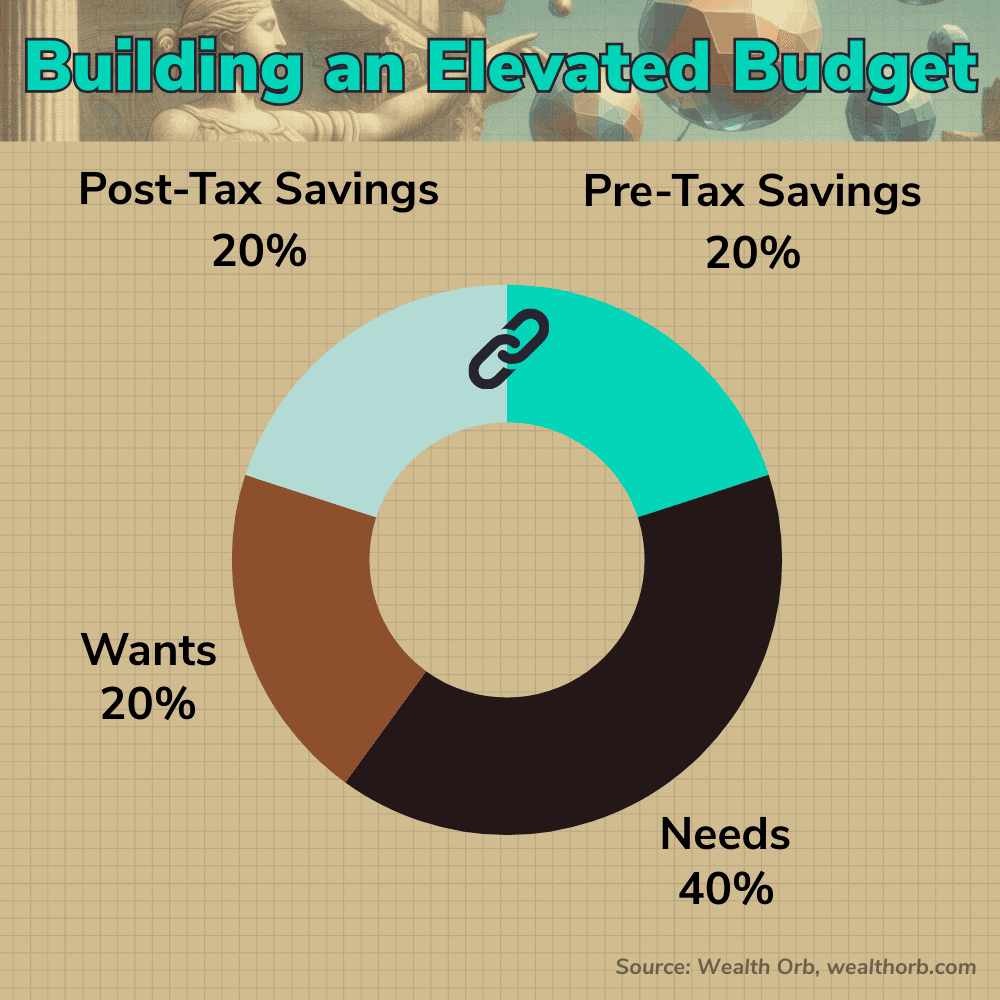

With the Wealth Orb Elevated Budget, the goal is to double down on the 50/30/20 and double the effective savings rate.

Who the Wealth Orb Elevated Budget works well for:

- People who are frugal or want to be.

- People actively pursuing financial independence and/or early retirement.

- People who are willing to make sacrifices and live beneath their means (delayed gratification) for long-term financial goals.

- People who want ironclad personal finances.

How the Wealth Orb Elevated budget works

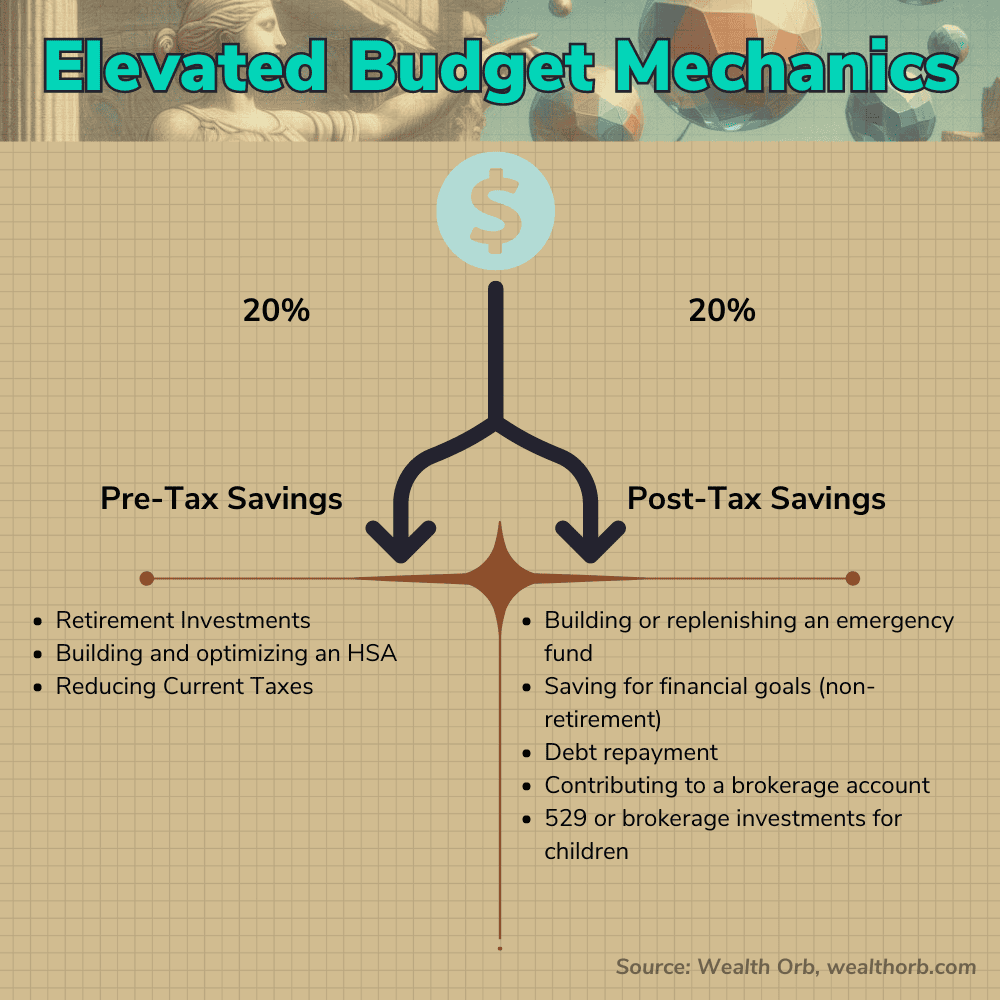

This budget approach works by doubling down on savings with the goal of saving 20% pre-tax and 20% post-tax. The categories and classifications are the same, but you’re working with a significantly reduced budget pool since you’ll target a 40% effective savings rate and only live on 60% of your income. The 20% savings rate both before and after-tax work in lockstep to improve your personal finances and create an ironclad foundation.

If you’d like to track it another way to make the numbers make sense in your head, it looks like this: Set aside 20% of your income pre-tax and invest in your 401k (or other applicable pre-tax account at work) and forget that money ever existed. Then go about budgeting with the 50/30/20 budget using only your post-tax savings for the saving category.

This budgeting approach has a few things going for it. Just like the 50/30/20 budget, you have room to work on both short and long-term financial goals, but this method of ‘forced’ retirement savings will almost certainly put you in a great financial position when you’re ready to retire. But it will also let you work on important post-tax financial goals that will improve your finances short-term and help ensure you’re in a great place. Here are the mechanics of this split savings approach in the Wealth Orb Elevated Budget:

With a steadfast commitment to building your retirement, you can rest assured that you are putting yourself in a good situation for later in life.

A few situations where you may want to reduce your 20% pre-tax savings for more post-tax savings:

- You are saving up for a near-term home or car purchase. It’s best to never tap retirement accounts for this purchase, even with penalty-free withdrawals for first-time home purchases.

- You don’t have a fully-funded six-month emergency fund. Or you had an emergency expense and you need to replenish your fund.

- You have maxed out your pre-tax contributions to retirement accounts for the year.

- You want to take advantage and max out a Roth IRA account after taxes and can’t comfortably do this while maxing out pre-tax accounts.

Use the calculator I made below to see your numbers using the Wealth Orb Elevated Budget approach.

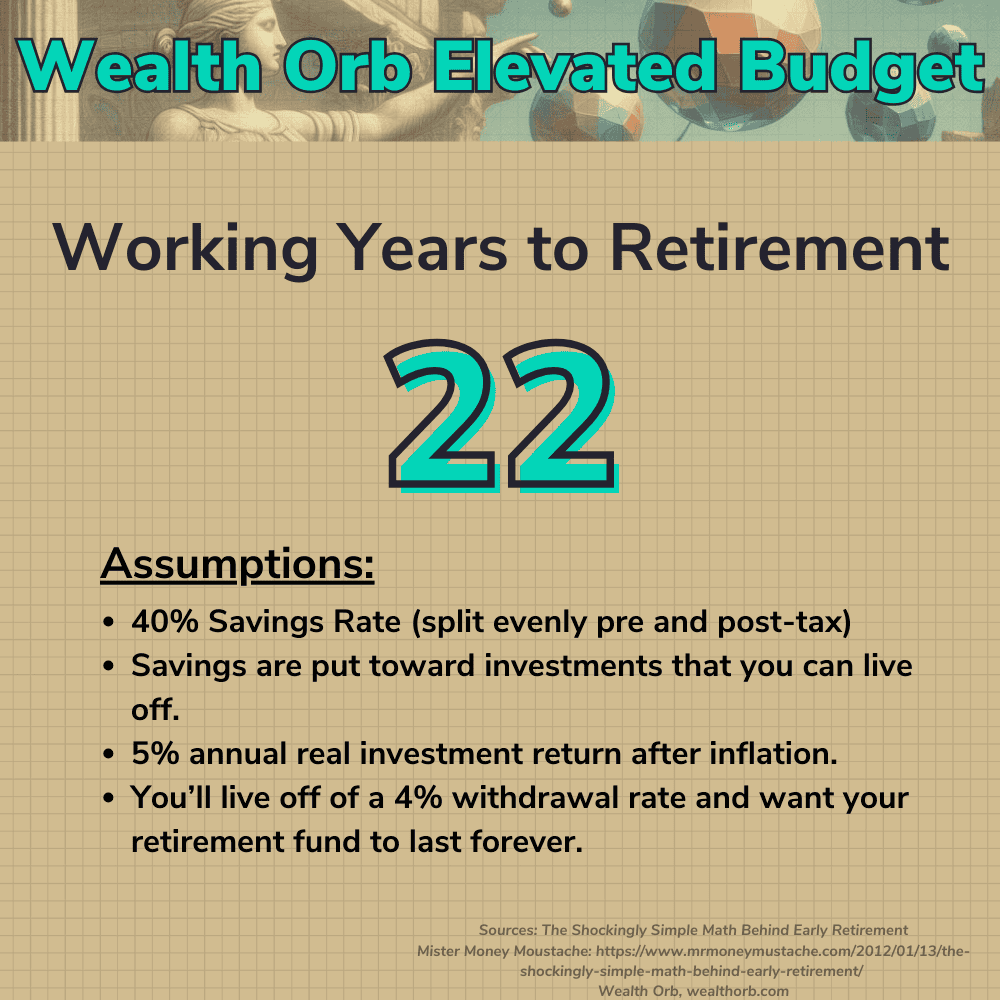

How long will it take to become financially independent and retire with the Wealth Orb Elevated Budget?

Using the same math and assumptions as the 50/30/20 budget above, we can calculate the new amount of working years it will take to become financially independent with the Wealth Orb Elevated Budget. With a 40% savings rate, it will take us only 22 working years to become financially independent and have the option to retire early. If you entered the workforce at 23 years old and used this budgeting approach from day one, you’ll be able to retire by 45. Not bad at all.

Remember that personal finance is personal!

As always, a key concept I like to stress is that personal finance is personal. The two budgeting systems above are great starting points, but they may not meet your specific needs. For example, you may want to try to max out your pre-tax retirement contributions every year and that may take more than 20% of your income to do so. That’s completely fine! Adjust and tailor the budgeting systems to work for your specific needs.

🟢 Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- Choose a budgeting model that works for you. The best budget is one that you can stick to. If you’re new to budgeting, ease into it and build the good habits that will fuel elevated personal finance for life.

- Tailor and adjust the thresholds to your specific needs and situation. Personal finance is personal!

- Use great personal finance software like Monarch to automate the heavy lifting. You’ll love having an instant snapshot view of your monthly finances and access to historical data.

- Your budget is the foundation of good personal finance. It’s your way to manage your money in and out. Without a budget, your finances can collapse and it’s hard to work on financial goals.

- There is no such thing as an ordinary month in budgeting. There will ALWAYS be surprises or irregular expenses. Plan accordingly!

💬 Reader suggestions for discussion

How do you budget and allocate your income to different spending categories?

What are some of the greatest struggles you have with budgeting?

What are some of your favorite budgeting hacks?

Comments