Welcome to the Wealth Orb Ultimate Personal Finance Guide to gift cards. For most of us, gift cards are an inevitable part of life, and they are actively designed to benefit the issuing company while ultimately hurting the consumer. In this guide, I’ll share everything you should know and do to optimize how you interact with gift cards so you can beat companies at their own game.

Let’s dive in!

Gift Cards are a controversial subject. On face value, a personal finance enthusiast can see them for what they really are: an interest-free loan you’re giving to a company in exchange for a piece of plastic or digital certificate that can be redeemed for goods or services at a later date. But the true intent, the thing the business is really hoping for is far more nefarious.

Why should you care about gift cards? a 2023 study by Blackhawk Network found that digital gift card sales saw double-digit percentage growth compared to the previous holiday season. Since they went mainstream in 1994 with stores like Blockbuster and K Mart, gift card popularity has grown exponentially over the years. They are here to stay, and you will only receive more of them over the years.

Let’s face it: It’s much easier to buy a gift card for someone than it is a traditional gift. You also know that the giftee will be able to find something they will like to purchase with the card. Gift giving can be difficult, and some people are notoriously difficult to buy for.

By getting people a gift card, we make it much easier on ourselves. It’s also much faster and takes the bulk of the effort out of gifting.

But when is the last time a gift card cracked the list of the top 10 gifts you’ve ever received? Unless the face value was astronomical, probably never.

Why companies issue gift cards

In order to learn how to beat these companies at their own game and leverage gift cards to the best of our ability within our own personal finances, we need to understand exactly how they work and what behaviors the company that issued the card is hoping to see from us as consumers.

Understand the rules of the game, then decide how to play to beat them.

There are MANY reasons why companies are more than happy to issue and sell gift cards. To show what this looks like at scale, it’s helpful to look at one of the largest gift card balance issuers of them all: Starbucks.

At the end of their 2022 fiscal year, Starbucks held $1.6 Billion dollars worth of outstanding gift card balances for their customers.

I was a Starbucks investor for years before transitioning to an index-fund only investor for 95+% of my public equity investments. I still believe Starbucks is a great company for many reasons. They are very smart at what they do, and you may be surprised to learn that selling coffee is only one piece of their business.

Starbucks has spent an enormous fortune on pioneering a great digital experience for their customers and making their rewards program more seamless and fun to interact with.

Everything on their digital platform encourages customers to buy gift cards, top off their account balance, and spend digital funds within the platform. For many reasons, Starbucks really doesn’t want customers to use credit or debit cards to do anything but top off their reward account balance–it drives more profit to the bottom line. Don’t believe me? Look at the transcript for one of their earnings calls and look how much emphasis they put on their reward spending program and user growth.

In the past, when I would listen to Starbucks earnings calls and shareholder meetings, it was fascinating to learn all that Starbucks was doing to build their digital customer experience.

Starbucks has become so focused on the financials of gift cards, account balances, and growing their deferred revenue balance, that they have enough money in ‘unearned revenue’ to be considered a major player in the banking industry. In fact, their FY 2022 Form 10-K shows that they had $1.6 billion dollars of gift card balances stored for their customers.

Interested into diving into the balance sheet? Ctrl + F and search for deferred revenue in the 10-k.

Remember that ominous and nefarious reason that companies issue gift cards I mentioned at the beginning of the post? here it is.

Companies like Starbucks declare their true intentions for the world to see in their earnings calls and financial filings like the Form 10-K. To save you from combing through almost 100 pages of very small font, I’ll share only the important passage. Read it closely:

Amounts loaded onto stored value cards (gift cards) are initially recorded as deferred revenue and recognized as revenue upon redemption. Historically, the majority of stored value cards are redeemed within one year.

Based on historical redemption rates, a portion of stored value cards is not expected to be redeemed and will be recognized as breakage over time in proportion to stored value card redemptions.

Breakage is recognized as company-operated stores and licensed stores revenue within the consolidated statement of earnings.

For the fiscal years ended October 2, 2022, October 3, 2021 and September 27, 2020, we recognized breakage revenue of $196.0 million, $164.5 million and $130.3 million in company-operated store revenues, respectively, and $16.7 million, $16.6 million and $14.3 million in licensed store revenues, respectively.

We need to understand how significant this really is and how TERRIBLE it is for consumers.

Between company-operated stores and licensed stores, Starbucks pocketed over $200 million dollars in revenue that they realized from gift cards they never expect to be redeemed. This breakage figure has grown over 50% from 2020 through 2023. With $1.69 Billion in gift card balances, they’re collecting almost an almost 12% annual return on capital that was borrowed for 0% interest from their customers.

Starbucks is collecting dividends from their own customers.

It’s a classic heads I win, tails you lose game, except for the coin used to play the game is actually a 20-sided dice and every face of the die says Starbucks wins the game and you lose it. Want to roll the die and test your luck?

Starbuck’s cash flows are improved when a customer buys a gift card or adds more digital balance to their account than they need at the point of purchase. Starbucks has reliably realized 5+% of deferred revenues on a yearly basis without providing any goods to customers in exchange. And that percentage is only growing and becoming more lucrative.

Starbucks will still earn ordinary profit from the coffee you purchase from them with your gift card. Your gift card sit in a drawer in your kitchen or tucked away in the back of your wallet for months or even years while inflation erodes your buying power. Your gift card will fall between the void of the couch cushions, or be otherwise chewed to annihilation by your dog, Chowder.

The list goes on,

How to win with the gift cards you are gifted or purchase

Now that you can see how stacked the odds are against you, oh lowliest gift card holder, we can work to build a strategy to beat these companies at their own game and get the most out of our gift cards.

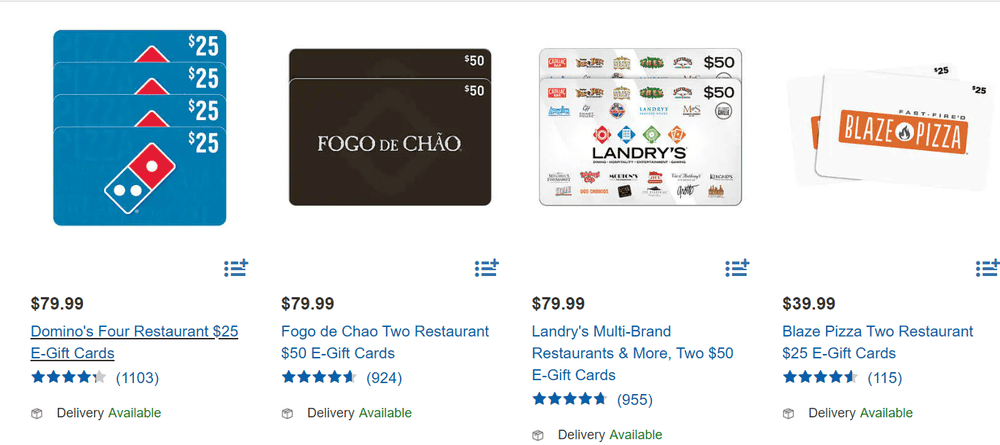

- ✨If you’re buying gift cards for yourself or others, buy them at a discount. This is the biggest way to ‘win’ against the companies that issue gift cards. If you can get them at a significant discount AND you follow all the other rules on this list, it can make sense. I’ll break this down further in the section below.

- NEVER buy gift debit cards for yourself or others. These are the worst offenders of all gift cards in my eyes. These debit cards require an activation fee that eats into your pocket without providing any real value in return. It’s like going into the bank, withdrawing $50 and paying a $5 convenience fee to withdraw it. Just give cash if you really don’t want to buy a gift card that doesn’t charge you fees. In general, avoid as many unnecessary or punitive fees in life as you can out of principle alone.

- If you’re willing to take a hit on face value, you can sell unwanted gift cards to gift card reseller websites. These websites will buy your unwanted gift cards at a discount, giving you cash in the bank. This can be a good option if you want to use your gift cards to work on your savings or investment goals instead of spending on things you may not need or value.

- Never purchase non-discount gift cards for yourself. If you’re buying gift cards or reward app balance for yourself and not getting a discount on your purchase, this is a suboptimal financial move.

- Only purchase gift cards for companies where you would spend money anyway and that fit into your budget strategy. Gift cards are not an excuse to neglect other areas of your personal finances.

- Don’t lose your gift cards, and be sure to spend them. The longer you wait to use your gift card, the more inflation will erode your buying power. Put all of your gift cards in one place and make a plan to use them as soon as possible. Don’t be part of the breakage line item in Starbucks’ financial statements.

- Look in your gift card drawer or pile every time you are planning an outing or to run some errands. My wife and I will try to use our gift cards on dates. Sometimes we’ll dig through our gift cards when we’ve already gone out for our weekly date and take a guilt-free ‘bonus’ date. Even if you’ve let your gift cards sit too long and erode with inflation, this can sometimes feel like ‘free’ money you can use spontaneously. Turn a negative into a positive!

- Try to bundle coupons or special offers & deals with your gift card spending. This can get you more mileage and help increase the odds that you won’t have to bust out your credit card to cover an overage when you’re spending gift card balance.

- Set the account top-off setting in digital reward apps to the smallest amount possible. Why help a company with their cash flows when you can improve your own? Try to limit any balance you carry in a rewards spending account you want to use. Save or invest the money instead! Why not throw that cash in a HYSA and earn some interest?

- Have a plan to use your gift card, but try not to spend more than your balance. It’s easy to use gift cards and end up with a higher balance than what the card can cover. This can lead to extra spending and budgetary pressure for your personal finances. Have a plan, and try your best to stick to it.

- Make a list or lists of things you will purchase with any gift cards you receive. I keep a list of books that I want to read/buy on Amazon. When I am gifted a gift card, I will prioritize using that reward balance on new books that I haven’t gotten to in my list yet. I can work on my personal and professional development and growth and not feel guilty for material spending.

- Let friends and relatives know what kind of gift cards you like. If you know they only want to buy gift cards anyway, let them know the places where you are most likely to use your gift card balance quickly and on things that will bring value and happiness to your life. This will help you end up with fewer ‘useless’ gift cards in your junk drawer.

When does it make sense to buy gift cards for others?

There are circumstances when it makes sense to buy gift cards for others:

- You are budgeting for your gift spending and are having a hard time finding something within budget for the giftee. Gift cards make it incredibly simple to stick to a budget and not go over.

- You are buying for someone who is difficult to buy gifts for or are short on time to buy a more thoughtful gift.

- Your giftee specifically requested a gift card as their present or REALLY likes a specific place or restaurant.

- You can get a good discount on the gift card you buy–you give more than you spend. You can effectively pocket the discount for your own savings or stretch your dollars for your giftee.

You will have a much better chance of avoiding the need to buy gift cards for others if you try to be proactive with gift purchasing and don’t procrastinate and wait until the last minute.

🎁 The Wealth Orb alternative to gift cards: I believe it’s better to invest time in finding great gifts for our friends and loved ones. These relationships matter, and it’s an admiral use of a discretionary budget once all your other financial goals and necessities are accounted for. Thoughtful (and responsible) gifting enhances our relationships and also brings joy to ourselves and the ones we love. Bonus points if you buy a thoughtful gift for someone you care about in your life just because.

Are discount gift cards worth buying?

Discount gift cards can be worth purchasing if you follow all the other rules on my lists above. Stick to them, and you’ll better avoid the company’s nefarious plans for gift card holders.

Now, let’s talk about discounts on gift cards and the rules of buying them when trying to optimize your personal finances and how you interact with the gift cards in your life.

- When considering purchasing a gift card, look at the discount rate and determine if you think you could beat it by investing or saving your money.

What’s the risk-free return of money right now (the interest rate of the 10-year Treasury)?

How much interest can you earn on your money in a high-yield savings account?

What about risk assets? If you can expect to earn 7% adjusted for inflation with a simple low-cost index fund, why would you buy a discounted gift card with a lower percentage? Of course, you also need to factor in how long you plan to hold the gift card. The sooner you spend it after acquiring it, the less this calculation matters. It’s also VERY minor in the grand scope of things. Do a quick mental calculation on this rather than build a custom spreadsheet to calculate it. Your time is worth much more spent elsewhere.

- Be careful of buying second-hand gift cards online. Second-hand gift cards are cards that were owned by another consumer instead of issued directly by a company. Only shop with reputable websites that offer a guarantee on second-hand gift cards and use your credit card (only if you’re never paying credit card interest) to purchase them so you have more consumer protection. Never buy second-hand gift cards from individuals you don’t know and trust, this is a great way to get scammed.

Gift cards at Costco

- Search for BIG discounts at shopping clubs like Sam’s and Costco. These shopping clubs are a great source of huge discounts on gift cards and are often the best place to buy them. A 20% discount is substantial–you’ll be hard-pressed to find similar yearly investment returns over a prolonged period of time. If you were planning on spending money at these vendors or spending categories anyway, heavily discounted gift cards can be a worthwhile purchase. Both Costco and Sam’s will have a revolving selection of discount gift cards, and you can often find different ones in their physical stores compared to online offerings. Keep an eye out for great gift cards from Costco and be ready to pounce. Just don’t go overboard on your spending and follow all the other rules in this guide!

Make gift cards work for your business

As we learned by studying Starbucks, deferred revenue is a beautiful thing for businesses. Customers are paying you today and purchasing goods and services tomorrow. The balance sheet will always balance in the end, but you are borrowing money without paying interest and can leverage the cash flows to help grow your business. Maybe you can even collect some breakage for yourself.

🟢 Orbs of Wisdom

- Understand how companies win with gift cards. You need to know their game to know how to beat them at it.

- Follow all the Wealth Orb rules when purchasing gift cards for yourself and others. Bookmark this guide so you can come back to it!

- Look for better alternatives to gift cards in your own gifting to others. This will enrich your life and the lives of those you love and care about.

- Make gift cards/store credit work for instead of against you by implementing them in your own business!

Comments