Whether it’s car insurance, a mobile plan, a new phone, or a favorite subscription. You will often be offered the ability to pay in advance, usually in exchange for some kind of discount on your purchase. In this blog post, I’ll break down the considerations you should have for paying in advance and show you when it’s better to pay in advance, and when it’s better to pay monthly or buy goods as needed.

The simple equation

It requires little explanation that you are not incentivized to pay in advance for a good or service if there is no discount for doing so.

Time = Money.

Money + Time = More Money.

You’re losing earning potential on your money by paying early, so it needs to be in your best interest to do so.

Deferred savings

The decision on whether or not to pay in advance revolves around the concept of deferred savings.

You can spend money today and have reasonable certainty, that you’ll improve your future cashflows by saving money on a product or service.

It seems simple enough, but it’s important to understand the risk of paying in advance, and when it does and doesn’t make sense from a financial optimization standpoint.

Game Theory: opportunity cost & optionality + agency

Game theory is the study of “the branch of mathematics concerned with the analysis of strategies for dealing with competitive situations where the outcome of a participant’s choice of action depends critically on the actions of other participants.”

Two core principles of game theory are optionality and agency. They go hand in hand.

Opportunity cost is more straightforward. It’s probably a concept you’ve been exposed to in one form or another.

For each decision you make, there is at least one opportunity cost associated with it.

If you choose to go on a date night, you can’t use the same time to go hang out with friends instead.

If you spend $100 on concert tickets, you can’t invest that $100 instead.

Opportunity costs are the things you forego when making a decision.

Optionality

Let’s drill into optionality.

Simply put, optionality is having and retaining options. Without optionality, you have fewer options and paths to explore in your decision-making.

Without optionality, you can be forced to make a bad decision, simply because it is the lesser of two evils.

In theory, if retaining optionality gives you an improved chance of a successful outcome in a situation, then you should place and be willing to pay a premium to retain it. And to willingly get rid of your optionality, you should charge a premium.

The challenge is that it can be difficult to quantify the benefits of optionality. And without being able to quantify the benefits, it can be difficult to know how much to pay for optionality. Or on the other side of the coin, how much to charge to sell your optionality.

One of the most common ways the majority of Americans trade away their optionality is in the form of 401ks and IRAs.

Retirement accounts restrict your savings, with the benefit of giving you the ability to defer taxes (and reduce current taxes) and avoid taxation on capital gains prior to retirement age.

But they come at a cost.

Outside of specific and limited circumstances, you cannot touch the money without a steep penalty until age 59 & 1/2.

You trade your optionality away with your retirement investments in exchange for the tax benefits.

On the other hand, a stack of cash on hand gives you a great deal of optionality. You can spend it on almost anything!

Think of optionality as potential energy waiting to be converted into different kinetic mediums.

Looking for a stack of cash? You’ll earn more of a raise from your portfolio than your employer,

Agency

Agency is your ability to make decisions and influence outcomes in your surroundings. It is the ability to turn the potential energy of your optionality into kinetic energy (impact).

When you have more agency, you feel more empowered and invested in an outcome. You feel like your decisions matter and that they are making a difference in an end result and the journey to get there.

Agency also helps foster a sense of autonomy and freedom, which can help contribute to psychological motivation and help you better achieve your goals.

With more agency, your wins feel more impactful. And even when you lose, the outcome feels less attributed to bad luck or chance.

In game theory, agency gives you more opportunity to learn and adapt your strategies over time. The more freedom you have to learn from your decisions, the more you can improve over time.

The greatest opportunity cost of exercising your agency, is that it often consumes your optionality.

You want to be damn sure, or at least reasonably confident, that this exchange will pan out in your favor.

Don’t pawn away your optionality by banking on the outcome of a coin flip.

Stack the odds in your favor before pulling the trigger and choosing to pay in advance.

The pain of paying (or lack thereof)

In Dollars and Sense by Dan Ariely & Jeff Kreisler, the authors explore the concept of the pain of paying for things. They evaluate data and conduct studies on how much pain there is in paying for something, and how much purchasers enjoy their purchase or experience based on when they paid for it.

What they found was that by pre-paying, most consumers end up enjoying the goods/services more when they are consumed later down the line.

Consumers don’t like the sense of weight in owing money, which is why they prefer to pay before consumption.

The correlation was especially true the more time had passed between the purchase and the actual consumption of it.

For example, consumers who pre-paid for a vacation experienced pain while paying for the vacation in advance, but by the time the vacation rolled around, enjoyed it much more because it felt almost free at that point!

A little upfront pain of paying can lead to more enjoyment of the future benefits of your purchase later down the line, from a psychological standpoint.

Companies know this and have even latched onto the methodology and studies to their own benefit!

Mint Mobile (the mobile provider I use, love, and recommend) plays into their annual plans by leaning into the ‘No Bill Chill Life’ in their advertising and sales tactics. If you pay upfront, you won’t have to worry about your phone plan for a year, it’s taken care of by your past self!

Goods VS Services: Paying in advance

With some assumptions, you’re much more likely to get better value as a consumer when paying for a product rather than a service in advance, especially if the service is billed monthly.

It’s easier to forecast your demand for certain products than it is to know if you’ll still be interested in keeping your HBO subscription after you finish watching House of the Dragon.

It’s also much harder to accidentally stumble into Costco and buy an extra pack of toilet paper than to forget to cancel the HBO subscription that will auto-bill your credit card every month.

Costco is a great example of a consumer-friendly pre-payment exchange.

I’m a big fan of Costco and know that by buying in bulk, companies are willing to pass savings onto me as the consumer in exchange for more revenue upfront.

it’s the right decision to buy toilet paper, coffee, and paper towels in bulk rather than in smaller packages as I consume them.

I’m 99.9% confident I’ll continue to consume these products in the future as long as I’m alive.

These savings are significant and real. Each time I pay more upfront to buy a product in bulk, I save more money later down the line.

So long as the per-unit discount makes it worth my time and money, it’s an exchange I’ll gladly make.

I like to think of it as buying future cash flows!

Provided you spend the same amount in other categories, you are buying future savings and better cash flow on your monthly budget.

This is true for each month beyond the first. Or however frequently you would have to buy the product again if you didn’t buy in bulk.

Why companies want you to pay for your subscription annually

Most companies that offer subscription services are for-profit enterprises.

They are not offering discounted annual subscription options out of the goodness of their hearts, they are doing it to boost their total revenue and value from their customers.

In his blog post on Subscription Index, Dan Layfield writes:

Every subscription business eventually figures out the monthly to annual plan pricing trick.

The trick is to figure out how long your average monthly user retains for and then price your annual plan to be 1-2 months more than that.

So, if your average user stays around for four months, price your annual plan at five months.

This allows you to increase your LTV by 25%, and it’s a really simple change to make.

We figured this out at Codecademy, and it was one of the highest ROI changes we ever made.

As also mentioned, this means that you can look at the ratio between the annual and monthly plan prices for most subscription companies and basically see how long they retain users.

This is in addition to capturing more revenue more quickly than by capturing a monthly payment from you and lowering transaction fees while doing so.

There’s a lot of insight here.

By purchasing the annual plan to a service, the company expects you to stick around for the same amount of time as the average user on their platform, but pay more to do so. You’re contributing to the LTV (lifetime value) of their customers by helping them improve their revenue.

You only win in this situation as the consumer if you stick around and use the platform longer than the average user.

Using the above quote, we know why Netflix doesn’t offer an annual plan for their subscriptions.

It means that their average user sticks around for more than 12 months. They have no reason to discount their service because the average user who signs up will stick around for more than a year. There’s no incentive or opportunity to boost their LTV, and offering an annual plan would hurt their profitability.

The pre-ordering example of paying in advance

One of my hobbies is PC gaming.

When I was a kid and played games, you used to have to go to the store and buy a physical copy of new games.

If you wanted it on release day, often you would have to pre-order your copy of the game well in advance. Or wait days, weeks, or even months for a restock.

Pre-ordering was a necessary measure to take back in the day if you wanted to play a game on day one.

Now, that isn’t the case. Game publishers can distribute unlimited digital copies of their games right now launch day, but the practice of pre-ordering remains.

To incentivize pre-orders and early revenue, game studios often add pre-order rewards or perks, in lieu of a discount on your purchase, hoping these provide enough incentive for customers to purchase an unvetted/unreviewed or otherwise unproven game.

There’s very little reason to pre-order something digital these days when there is no scarcity or lack of supply. Be careful if you choose to do so, because all of the risk of buying a subpar product or service is on you. Make sure the upside to pre-ordering anything digital outweighs the potential risk of disappointment.

For physical products, pre-ordering can still make a lot of sense when supply is finite, though you are still subjecting yourself to the risk of an unproven product.

Think carefully about the decision to pre-order anything. You may get burned!

When to pay in advance and when to hold off

The S&P500 has historically returned 10-12% annually before inflation.

That’s the metric to beat.

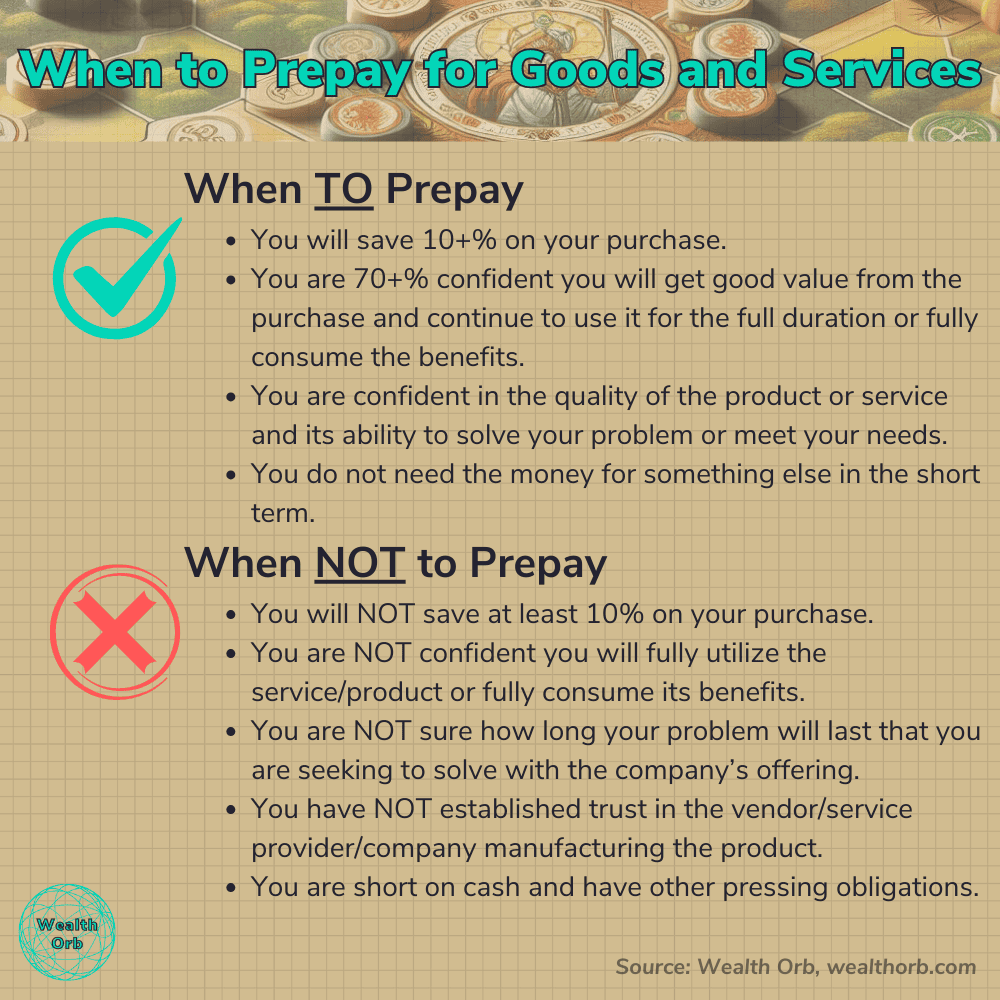

If I will be paying for a service a year in advance, I want to make sure I am saving at least 10% on that purchase AND I am at least 70% certain I will continue to consume that service for the full year.

If I am paying for a product and buying in bulk, I want to see similar savings or discounts, targeting or exceeding that 10% mark if possible.

With Costco toilet paper, for example, you’ll save around 10% compared to other toilet paper options and get a more premium product at the same time. Win-win!

Remember, you don’t pay tax on savings or rebates. The IRS won’t come knocking on your door asking for extra taxes because you saved $5 on toilet paper. This can be a great area to explore when optimizing your finances and improving your cash flow!

The biggest risk in pre-payment is often your inability or unwillingness to continue to consume a product or service. If there’s a risk you may only need the product or service short term, or you aren’t certain you’ll continue to use it, don’t prepay.

Value your optionality and don’t take it lightly. And be selective on when you want to exercise your agency to make decisions that impact your finances!

🟢 Orbs of Wisdom – Pay in advance

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- Don’t mindlessly pay in advance for products or services. Make sure it is in your best interest to do so!

- Consider the different nuances of paying in advance for goods and services and digital and physical products.

- Spend with intent and mindfulness and put your savings to work on your other financial goals.

- Understand WHY companies offer annual discounts on subscriptions and how the odds are stacked against you in most cases.

💬 Reader suggestions for discussion

- What products or services do you pay for in advance? Which do you purchase in smaller amounts or every month instead?

- How do you decide when paying in Advance is in your best interest?

Comments