In software development, micro-frameworks are a term used to describe a minimalist approach to development architecture. micro-frameworks lack full and complex functionality but are able to specialize in completing core tasks without a long list of dependencies. Simply put, you can drop them into your code and they *should* just work.

The beautiful thing I’ve realized is that we can build powerful micro-frameworks in personal finance and apply them immediately. You can take the systems and processes you’ve already built, drop in new micro-frameworks, and see what happens. In most cases, they should do more good than harm and allow you to tinker and improve your finances over time.

What are micro-frameworks and how will they benefit you in your personal finance journey?

Similar to their role in software development, personal finance micro-frameworks should serve the purpose of completing core tasks without a long list of dependencies. They should be focused on helping you make better financial decisions and lead toward better financial outcomes.

Micro-frameworks in personal finance could be centered around various goals like:

- Saving money for a goal like buying a car or home

- Building retirement savings

- Developing career skills

- Sticking to a budget

- Preventing or mitigating excessive lifestyle creep

To improve outcomes, personal finance micro-frameworks should be heuristic, meaning they don’t have to be mathematically perfect, but they should serve as a mental shortcut to reduce decision-making fatigue.

Remember, any decision you make that helps you build wealth over time will compound and improve your outcome.

Micro-framework synergy

Micro-frameworks are a perfect example of synergy in action. Synergy happens when things come together and achieve a result greater than the sum of their parts. Micro-frameworks will interact with other micro-frameworks and form interesting and powerful interactions.

By following the rules of each micro-framework, you may experience unexpected results, and that’s okay!

That’s synthesis in action.

Now, let’s jump into five micro-frameworks that can help you build wealth, including one for each of the categories above!

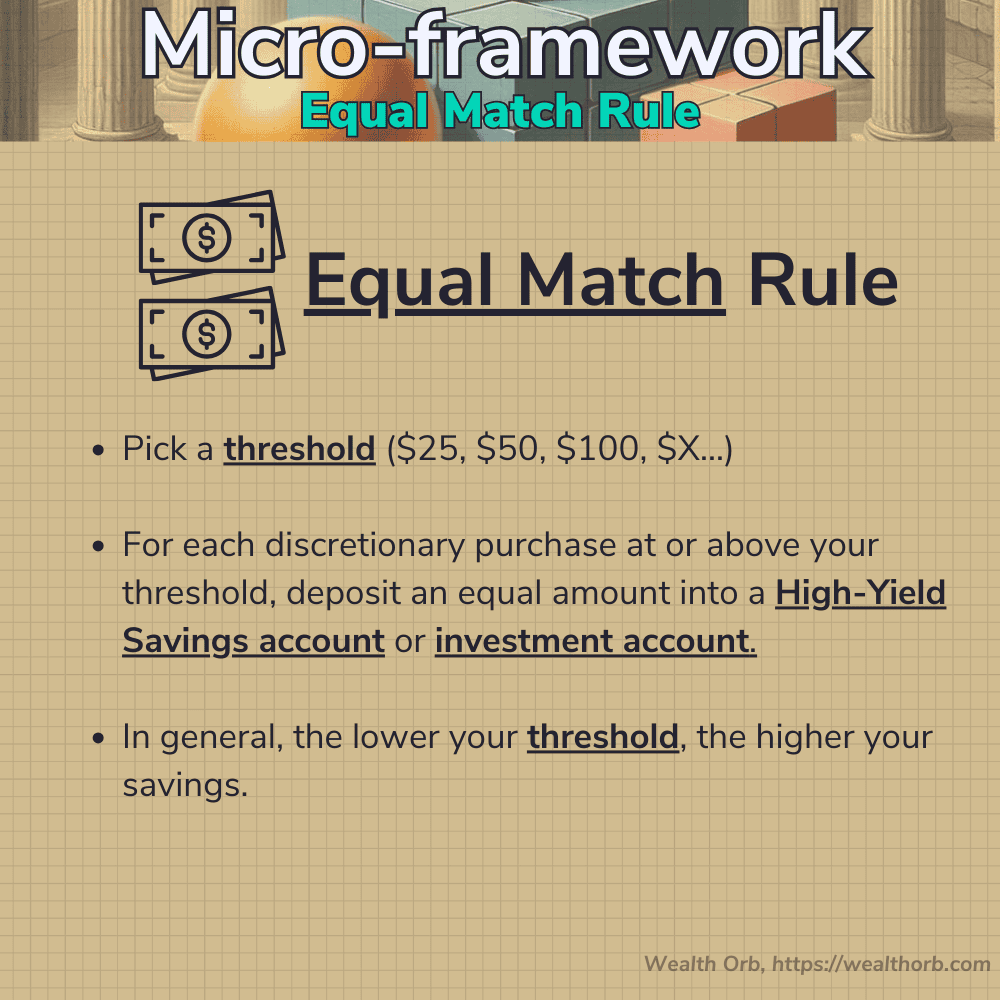

Micro-framework #1: Equal match rule

Let’s say you want to save up for a near-term downpayment on a house.

Great goal!

A simple micro-framework to help accomplish the goal is taking a closer look at your discretionary purchases above a threshold of your choice (try starting with $25, $50, or $100).

For each one, require yourself to match the purchase price and make an equal deposit into a high-yield savings account or vault where you won’t be able to easily access or touch the money.

This will have the double effect of helping you save more money toward your goal and helping you more closely evaluate your purchase habits to decide if you need certain discretionary purchases or if they can be cut.

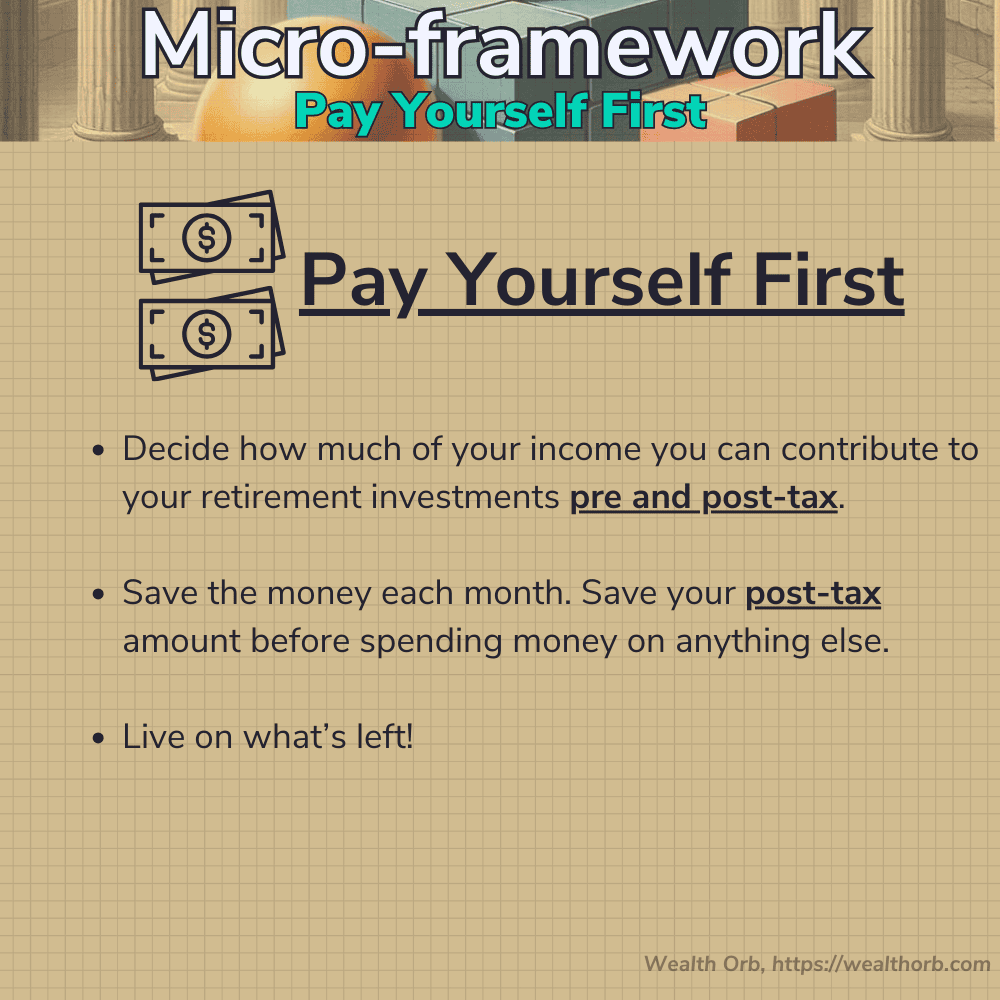

Micro-framework #2: Pay yourself first

One of the best ways to reliably build retirement savings is to take advantage of tax-advantaged retirement accounts.

The micro-framework for this example is to pay yourself FIRST, before and after tax, before paying any bills or expenses.

If you ain’t first, you’re last. – Reese Bobby, Talladega Nights: The Ballad of Ricky Bobby.

Who knew Ricky Bobby’s dad gave great financial advice?

As a non-negotiable, contribute at least enough pre-tax to earn your employer retirement plan match (if applicable.)

Then, decide how much money you can contribute to retirement investments pre and post-tax.

Save the money each month BEFORE you spend money on anything else.

Live on what’s left. Do this consistently, and you technically don’t need a budget since your savings goals will be met.

This micro-framework is that powerful.

This micro-framework appears in the Wealth Orb Elevated Budget which I wrote about extensively in this blog post.

Micro-framework #3: Invest in yourself

During your early working years, time is plentiful and you should do whatever you can to establish your human capital—the skills, knowledge, and experience you possess.

One of the most powerful things you can do to improve your personal finances is to invest in yourself and your human capital.

Earning a higher income is one of the most powerful levers you can pull in personal finance to save and invest more money and achieve financial independence faster.

This Micro-framework focuses on striving to learn new skills and knowledge that will make you more valuable to employers, directly incentivizing a bump on your paycheck.

Determine where you want to go in your career. What are your long-term ambitions? What skills/knowledge do you need to take the next step in advancing your career?

The framework is simple. Pick a time period where, at a minimum, you want to make demonstratable progress to learning a new skill or improving an existing one. Map the skill/knowledge to your career ambitions, and make it happen!

Certifications are a great approach to this. They allow you to demonstrate mastery of a marketable skill to employers and help build your credibility as a subject matter expert.

My own story

In my own career, when I was transitioning from a marketing role to a technical IT consulting role, I identified getting my Professional Scrum Master Certification as one of the highest value things I could do to improve my income and map to my ideal career trajectory. In early 2020, I started studying.

At the time, I was earning $53,000/year in my second year out of college in my marketing position. The Scrum Master certification didn’t have any value to my skills in marketing, but it would help me demonstrate to my employer that I had the skills and drive to perform in a consulting position. It was a risk, but a calculated one.

After aggressively studying and earning my Scrum Master Certification in a week’s time, I was able to negotiate a position change at my company and start working as a consultant earning $65,000 a year (22.6% salary increase).

After another two years, I was up to $80,000 a year (50.9% increase from my salary in marketing), then used my improved human capital to negotiate a position at another company surpassing the six-figure mark five years after graduating with my Bachelor’s degree (153% increase from my salary in marketing).

The Scrum Master certification required an investment in my time and around $300 for study materials and the exam fee, but it’s paid for itself countless times over. I still use the skills and knowledge from this certification in my day job. The certification gave me a direct path and opened up the opportunities needed to drastically improve my income.

I hope this demonstrates how valuable investing in yourself can be.

Take a chance, learn new concepts, and work to earn certifications that can open up opportunities for higher income and new jobs. If you’re curious, I wrote this article on my experience earning my Professional Scrum Master certification in one week’s time.

Comfort is the enemy of progress.

Work hard and push yourself toward your career aspirations, but fight to achieve work-life balance.

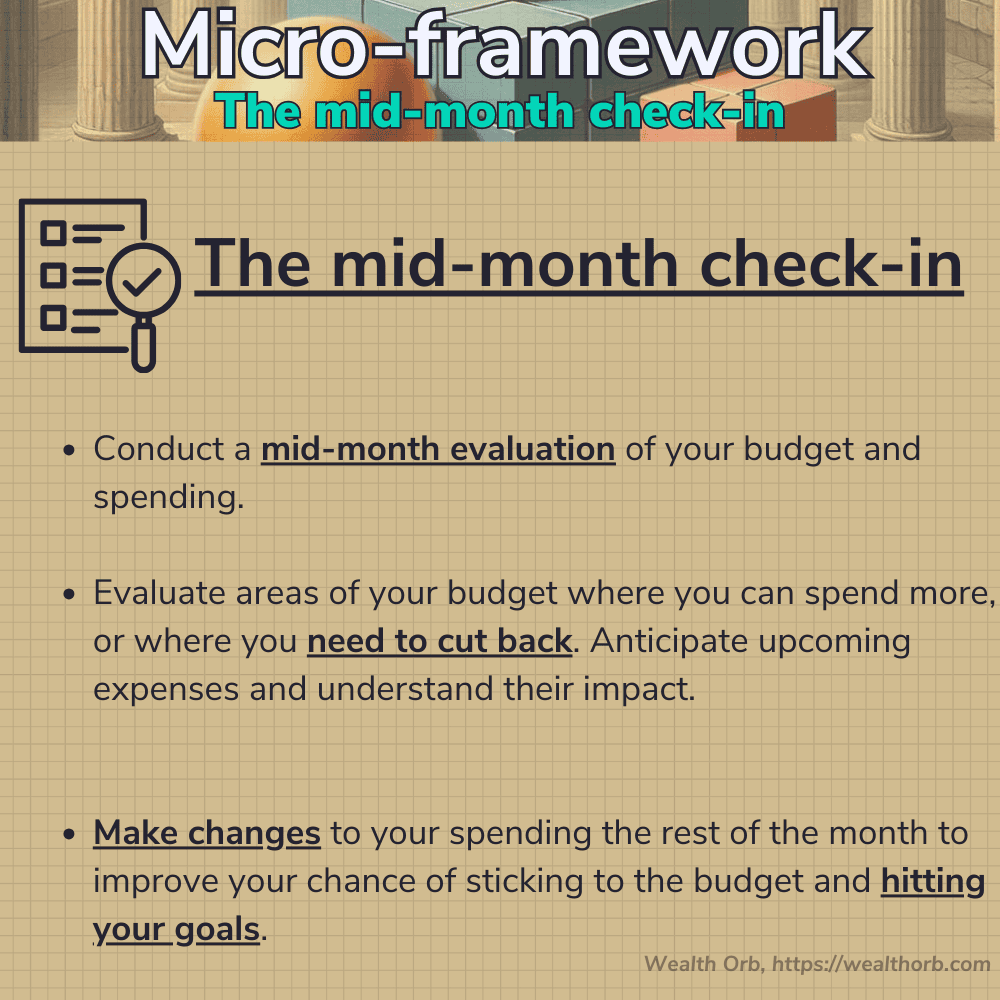

Micro-framework #4: The mid-month check-in

During long voyages, commercial and military ship captains and crew often undertake several specific actions and evaluation procedures at the halfway mark. This gives a chance to evaluate how things have gone so far, and what corrective actions, if any need to be taken for the latter half of the journey. These are things like:

- Positional checks

- Weather check

- Fuel and supplies inventory

- Engine and equipment inspection

- Communication check

- Crew welfare check

- Course adjustments

Your monthly budget is really no different and benefits from the same methodology used by ship captains.

And by all accounts, you SHOULD be the captain of your own budget. No one else is going to steer the financial ship for you.

This micro-framework is simple. Conduct a mid-month check-in on your budget and how you’re doing.

Pro tip: It helps to have great personal finance budgeting software. I personally use and love Monarch.

Check in on how you are doing on your spending for the month.

How are you trending in your various categories? Is anything burning too hot? Where do you have more room to spend? And where do you need to cut back? What other expenses do you expect for the remainder of the month?

Even spending just 10-15 minutes every month doing this exercise can help tremendously with sticking to and hitting a budget.

You can right the financial ship and make adjustments to maximize the likelihood of a successful monthly financial voyage. Budgeting is also critical to achieving your other financial goals!

Savings = income – spending.

It’s that simple.

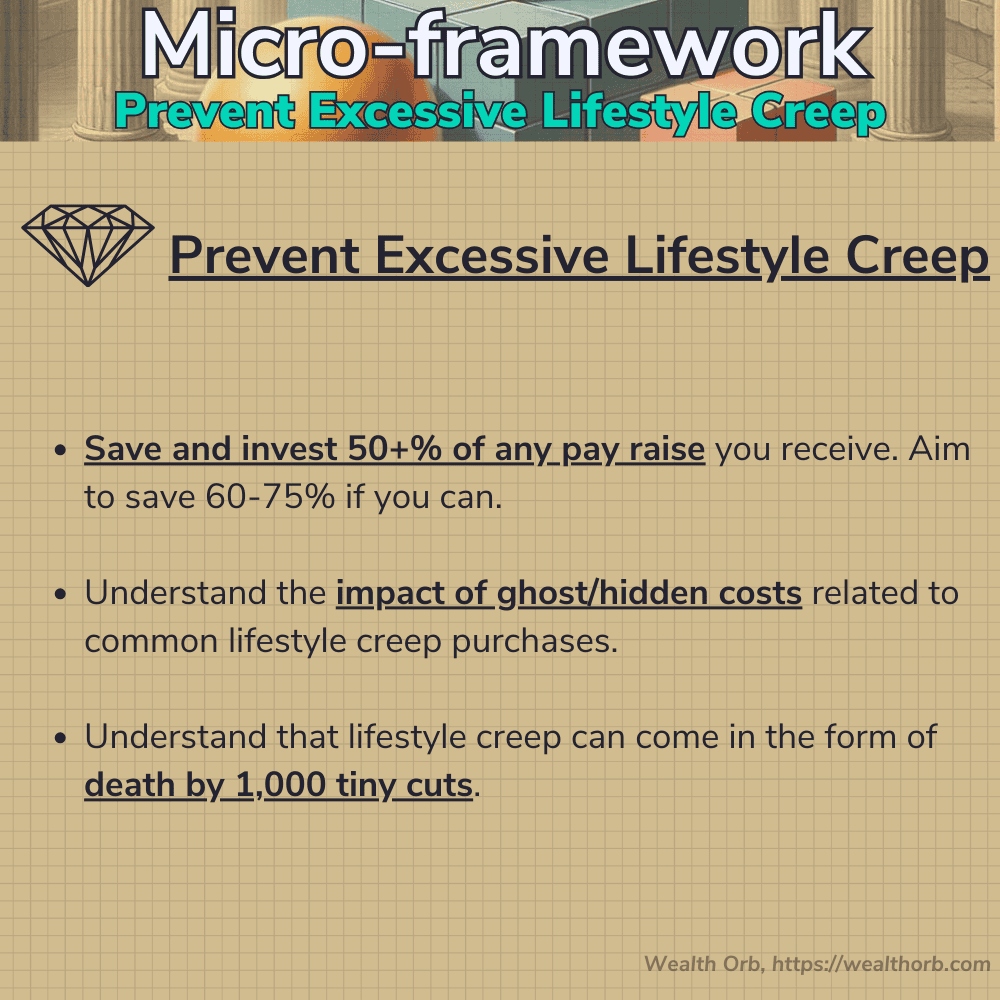

Micro-framework #5: Prevent Excessive Lifestyle Creep

Inevitably, if you work on improving your human capital and skills during your working years, that will likely translate to a drastic increase in income. To improve your personal finances, you need to try to reduce excessive lifestyle creep and ever-growing expensive tastes.

In my opinion, some lifestyle creep is healthy and encouraged. We should enjoy our wealth, within reason, at all stages of life.

I’m not going to tell you not to go out with a loved one for a nice dinner to celebrate a raise and a job well done. Go for it and enjoy the experience and memory.

This micro-framework couldn’t be simpler. Save/invest 50+% of any and all raises you receive. If you can, aim to save 60-75% of each raise.

Say it with me. Spend. The. Rest. Improve your quality of life. Take that vacation with loved ones you’ve been putting off. You’ll still be working toward your goals and will be in a better position than you were before.

If you give a mouse a cookie

Unfortunately, it’s called lifestyle creep for a reason. It creeps & sneaks up on you.

That’s why it’s so important to understand any ghost/hidden costs of ownership associated with these purchases and thoroughly do your homework.

One of my favorite children’s books growing up comes to mind: If You Give a Mouse a Cookie.

In the case of personal finance, the cookie represents your raise. Watch the read-through of the book and see how true this rings.

Once given your raise, you’ll buy something new and shiny only to realize you need something else to go along with it, unleashing an almost unstoppable chain reaction of spending events. One that inevitably negates any potential financial gain from receiving the raise in the first place and sets you further back from your financial goals.

Think about a time you started a new hobby. One purchase led to the next led to the next, right?

Big purchases with hidden costs

Here are two big examples and their hidden costs that you may not account for when looking at sticker price:

Buying a bigger home: higher insurance cost, more expensive to heat/cool, increased home repair costs and maintenance, larger landscaping bill, larger potential insurance liability and deductible for hail/etc.

Purchasing a new car: higher insurance cost, more expensive maintenance, wanting a car wash membership. Ordering expensive cleaning products for the car, etc.

But the scariest thing is that expenses don’t have to be huge to work against you and cause lifestyle creep. They could be as small as going out to eat more often or getting an extra Starbucks. Buying that subscription to HBO now that House of the Dragon season two is out. You promise you’ll cancel it when you finish the season, right? …. Right?

Lifestyle creep can come in the form of death by a thousand cuts so watch out!

Pay yourself first, and invest and save a large portion of any and all raises you receive before you spend the rest!

🟢 Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- Micro-frameworks interact with other micro-frameworks to create synergy: an outcome greater than the sum of individual parts.

- Create your own micro-frameworks and tinker with the percentages or multipliers to work for you!

- Adjust your micro-frameworks and ditch the ones that aren’t working. Seek new ones to add to your toolkit.

- Continue to read Wealth Orb for new micro-frameworks to activate in your life!

💬 Reader suggestions for discussion

- What micro-frameworks have you adopted in your own life?

- Have you tried some variations of any of these micro-frameworks? What was the impact?

- What other areas of your life outside of personal finance are you interested in applying micro-frameworks?

Comments