There is immense value in failing in many aspects of life, including personal finance. In today’s blog post, I’ll share how you can fail your way into better personal finance and learn lessons that will fuel you for life. The mishaps and failures along the way provide the building blocks for better decisions and opportunities in the future and have more value than you know.

Let’s begin with a story, dating back to the early 1800s: the origin story of Worcestershire Sauce. Regardless if you can pronounce the name of the sauce or not, there are many lessons to be learned.

The origins & mishap of Worcestershire Sauce

Worcestershire sauce has an intriguing history dating back to the 19th century in Worcester, England. In the early 1830s, Two chemists, John Wheeley Lea and William Henry Perrins worked as partners in their small shop which sold pharmaceutical remedies and experimented with culinary creations and the science behind cooking.

Little did they know, they would soon create the famous culinary staple Worcestershire sauce, revered to this day for its ability to enhance and create complex flavors.

Lord Henry Sandys was returning from his journey to India, bringing back a love of a particular sauce he had tasted. It became an obsession for him. He learned all he could about it while in India, inquiring about ingredients and gathering everything he thought he needed to try to commission and replicate the sauce for his meals back in England.

The nobleman commissioned John Wheeley Lea and William Henry Perrins to recreate the sauce, sharing his notes, ingredient and flavor profiles, and the knowledge he had acquired during his travels.

The chemist dynamic duo got to work immediately, attempting to replicate the sauce with ingredients like vinegar, molasses, anchovies, tamarind, onions, garlic, and spices. But when they had finished, the resulting sauce was an utter failure and was far from palatable.

Dismayed at their failure, the business partners stored the jars of the inedible sauce in their cellar and forgot all about it.

Powerful and unexpected transformation

18 months later, Lea and Perrins rediscovered the dusty jars of sauce they had stored and decided to taste it again. What they found was nothing like the original sauce that had been stored months ago. The sauce had fermented and matured, developing a complex and flavorful profile. Through the process of aging, the once-inedible sauce transformed into a savory, tangy, and umami-rich condiment that would go on to become a culinary staple across the world.

Thankfully, the chemists had saved their notes and the original recipe they used to create the batch of sauce.

Recognizing the potential of this accidental creation, Lea and Perrins decided to market the sauce and sold it commercially as Worcestershire Sauce beginning in 1837. With passion and drive, the chemists worked hard, convincing British passenger ships to include it as a condiment on their dining tables. By 1839, it was being sold in New York and would go on to become a worldwide staple.

To this day, the exact recipe for Worcestershire sauce is a closely guarded secret. The original recipe, commissioned by lord Sandys, remains in production. In 2004, the Royal Society of Chemistry honored the chemists who created it, dedicating a plaque and the Midland Road Factory in Worcester, acknowledging their accomplishment and contribution to the world of culinary art and science.

Give your failures time to mature (and learn from them!)

By all accounts, Lea and Perrins failed their commission and to recreate the sauce initially. Instead of discarding and erasing their mistake, they inadvertently allowed it to transform into something of value.

The same lesson can be applied to personal finance.

Financial missteps like poor investment choices (crypto, NFTs, Ponzi schemes, or even the latest hot individual stock) or unexpected expenses that create hardship can be valuable learning opportunities for the future.

Often, the byproducts of failure are more valuable than the perceived value of an initial successful outcome.

In my own life, I had to be burned by buying individual stocks and attempting to beat the market to learn that I was not smarter than everyone else. I quickly learned I should buy and hold low-cost index funds as a way of cheap and efficient diversification.

In my first year of marriage, I had to learn through the lesson of being hit by an unexpected tax bill from the IRS that threatened to wash out almost all of our fledgling emergency fund. Unexpected expenses (sometimes large) can and will happen. That’s why it’s so important to have a budget and an optimized emergency fund.

By taking a step back and analyzing the financial mistake you’ve made in the past, you can make informed decisions in the future. Embrace your failures as stepping stones to become your best future self.

The value of patience and time

The sauce Lea and Perrins created needed time to develop its unique flavor and age. Initial disappointment turned into success due to the unplanned fermentation process.

The same lesson can be applied to personal finance. Building wealth and financial stability requires patience and trust in the process, plus allowing time to work its magic.

Investments, retirement accounts, and savings will all grow over time, given you trust the process. Volatility and market fluctuations are the price of admission for owning risk assets like stocks that help grow wealth in personal finance.

Sadly, (or perhaps fortunately) we can’t ferment our money. But you can trust in the process and allow the systems and processes you create time to lead to better financial outcomes. I suppose compounding is the equivalent of fermentation in extracting lessons from this allegory. Similarly, career growth takes time. Dedication, persistent career development, and lifelong learning can lead to unexpected opportunities.

Flexibility and adaptability

Lea and Perrins were flexible enough to recognize the potential of their initially failed product. Maybe it was by chance that one of the two decided to try the sauce again after all those months in the cellar. And perhaps that represents some component of luck in the equation of success. But the chemist partners immediately recognized the opportunity that had fallen into their hands and decided to act upon it.

Being perceptive to unexpected opportunities can significantly improve your financial outcomes. Whether it’s a sudden investment opportunity that opens up because you have excess cash, a career advancement opportunity, or a new side hustle idea. Being open to these new opportunities can make all the difference in end outcomes.

Flexibility in financial planning is crucial. The only constant in life is change. All we can do is use the information we have on hand to make the best choices possible. Throughout your financial journey, you may need to adapt your strategies to diversify investments, adjust your savings goals, or find new sources of income.

Turning setbacks into opportunities and the importance of persistence and resilience in personal finance

You will be faced with adversity as well and will have to weather challenging events throughout your life.

Boxxer Mike Tyson famously said, “Everyone has a plan until they get punched in the face.”

Our failures and setbacks can be the building blocks of incredible future milestones. Once we recover from the financial equivalent of being punched in the face.

Adversity may appear in the form of a job loss, needing to take on unexpected debt, or weathering market downturns that erase a significant portion of your portfolio’s value. Look to turn these setbacks into opportunities for your future self, no matter how gloomy the situation may look at the time.

My own story

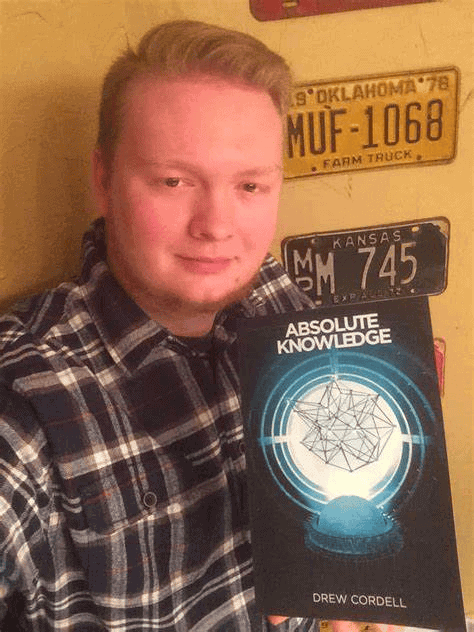

Since my senior year of college, I have written and published six full-length science fiction novels (the latest being in 2019). Despite my best efforts and tireless investment of time into learning new skills like marketing and sales, I failed in my goal to go full-time as an author.

To date, I’ve earned just slightly over $12,000 in total royalties from my books over 7 years’ time. With the 1000+ hours invested to get to that point plus all of the costs, I barely cleared minimum wage.

Sadly, while I may want to publish more books in the future, it requires countless hours of work to write, edit, and publish a book. Further, the opportunity I identified in self-publishing back in 2017 has become supersaturated and competitive. The emergence of AI in the space makes it even more daunting to write, market, and successfully sell books.

What I didn’t understand when I was starting my novels was how valuable the skills I was learning were.

I drastically improved my skills as a writer, as a marketer, and as a seller. I learned how to create and manage websites with WordPress, write better blog content, and the basics of SEO.

In fact, my tireless work on my books opened up opportunities that turned into a chain reaction of opportunity.

In 2018, I interviewed for a marketing coordinator role at an IT consulting company called Quisitive. I had already proven through marketing my books that I had the skills needed to perform and optimize email marketing campaigns. I had proven that I could market and sell products and services. And that I was a lifelong learner dedicated to learning and improving my skills. I demonstrated that despite being a broke college kid, I could use my background in entrepreneurship to crowdfund my novel.

As a prop, I even brought a physical copy of my first novel to my job interview at Quisitive.

Despite the lack of realization of tons of sales in writing my novels, the skills I learned paid off. I didn’t give up after my first novel had failed. I continued to work at it and publish more, banking on my persistence and resilience.

Fortunately, I got the marketing job with Quisitive with a starting salary of $45,000. I was also the lowest-paid employee at the company and that motivated me to work to improve my skills and change the situation.

I worked hard and worked my way up through the company and eventually transitioned to a more technical (and higher-paying) role as a business analyst consultant. In this new role, I capped out at an $80,000 salary. After a couple more years, I used everything I had learned and all the skills I developed to land a six-figure salary at another company, Lantern, where I work today.

My writing side hustle was a path to a better career and better financial outcomes for my family. Yes, luck was still a component, but I know I am where I am today because of my hard work and openness to capitalize on opportunities as they emerge.

My persistence and resilience in continuing to write my books and develop new skills paid off in a big way. Though not in the way I had expected when I first sat down and started working on my novels. It’s probably easy for you to see why reading the story of Worcestershire Sauce resonated with me. Much like Lea & Perinns, I found that success didn’t come immediately and when it did, it wasn’t in the form I envisioned.

Had they found initial success in creating the sauce, I would bet that Lea and Perinns would have happily taken a one-time payment from Lord Sandys for the commission work.

Lord Sandys may have returned and ordered more sauce, but I’d argue that Lea and Perinns wouldn’t have found such profound success. Only after their failure and the fact that they were left with something valuable (and no longer tied to a commission contract) did they realize they could build something more for themselves.

Unexpected outcomes and opportunities can steer us toward different paths in life, ones we never envisioned for ourselves. But by remaining flexible and open-minded, we can be ready to capitalize and seize these opportunities as they emerge. This can lead to significantly better personal finance.

Often, the byproducts of failure are more valuable than the perceived value of an initial successful outcome.

I hope you can apply some of the lessons of Lea and Perinns in your own life and personal finance.

🟢 Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- Stay open and perceptive to new opportunities that may differ from your expectations.

- Don’t be afraid to take some risks on new opportunities, especially while you are younger and have less to lose.

- Learn from your failure and apply that knowledge to make better decisions in the future.

- Stay resilient and trust in the process. But be adaptable and willing to make the changes necessary for success in personal finance over time.

- Comfort can be the enemy of progress. Embrace change and use the information you have to make the best decisions possible.

- Seek counsel from loved ones and/or those who have walked the path before you and learn from them.

💬 Reader suggestions for discussion

- What failures in your own life have you been able to learn and grow from?

- What failures have led to unexpected opportunities for you?

- How have your failures helped you learn and develop new skills?

Comments