I’ve been a proud owner of the Venture X Capital One credit card for over a year now, and want to finally publish my Venture X review after a full year of using the card. The Capital One Venture X is a premium travel card with a $395 annual fee. Still, a simplistic reward and benefit structure makes it a compelling option for individuals looking to earn strong credit card rewards from their spending and put them toward travel. Let’s dive into the Wealth Orb Venture X review!

This is NOT a sponsored post. This is a completely independent credit card review based solely on my opinion after owning and using the card for over a year.

The Capital One Venture X Overview

For a $395 annual fee, you get quite a lot from Venture X. Let’s cover the reward miles for purchases first.

Recommended credit to apply: 740-850 (Excellent)

| Expense Category Reward | Reward Miles Back % |

| Hotels and Resorts and Rental Cars* | 10% |

| Flights* | 5% |

| Everything Else | 2% |

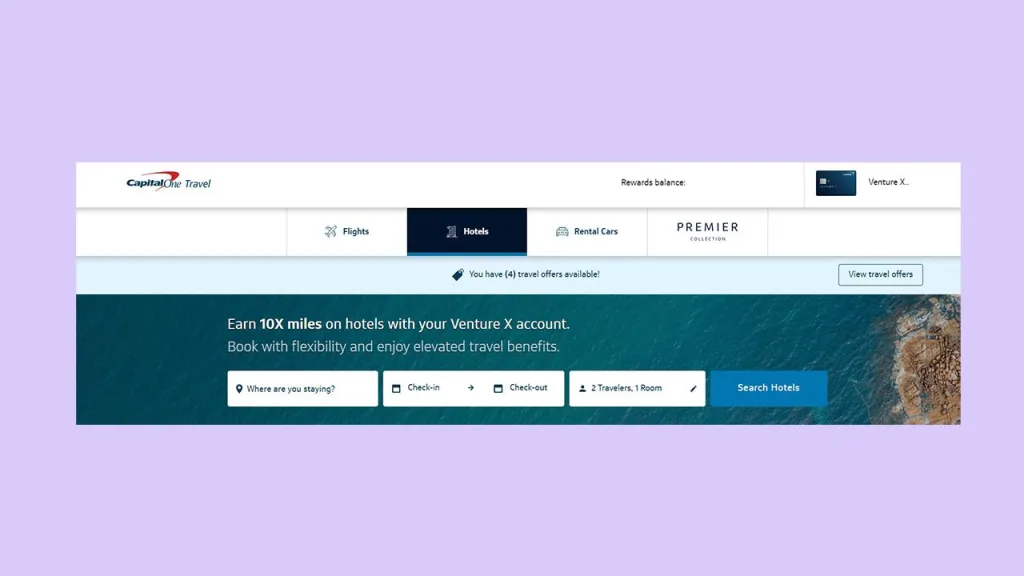

2% on everyday purchases isn’t a bad earning rate, but this card shines when used through the Capital One Travel Portal to book flights and hotels and resorts, earning an impressive 5% on flights, and 10% back on hotels and resorts. You must use the Capital One travel portal to earn 5 & 10% miles on travel purchases.

Capital One Venture X Benefits

For a $395 annual fee, we need to command a lot of benefits from this premium travel card to make it worth the fee.

Starting my Venture X review, I’ll break down the benefits of this premium travel card and what you can expect.

75,000 mile welcome bonus

When signing up for the card, you’ll earn 75,000 miles after spending $4,000 within the first three months of owning the card. This equates to $750+ of rewards for your first year! You’ll also earn any reward miles on top of all those purchases so this is a great way to build up some momentum and miles to put toward a family vacation or some travel. With some of the transfer programs available for the miles, Capital One miles can be valued at up to 1.85 cents each, making your 75,000-mile welcome bonus worth up to a staggering $1387.50.

Earn the 75,000 welcome bonus and help support Wealth Orb by signing up with my link.

Capital One Travel portal

The Capital One Travel portal is simple to use and often has great prices listed for both hotel and flight bookings. Flight bookings made through the portal have automatic price drop protection, meaning if the price drops within 10 days of your booking, you will receive an automatic statement credit of up to $50 to help cover the difference. If you find a better price within 24 hours of your booking, Capital One will match it and give you a statement credit. So far, I haven’t been able to find a better price on my own outside of the portal.

Pro tip: Never use your Miles to directly pay for travel in your bookings. Instead, pay the full amount, then reimburse yourself later in the Capital One app to ensure you’re not missing out on earning extra miles. Read more about why in this article by Thrifty Travel.

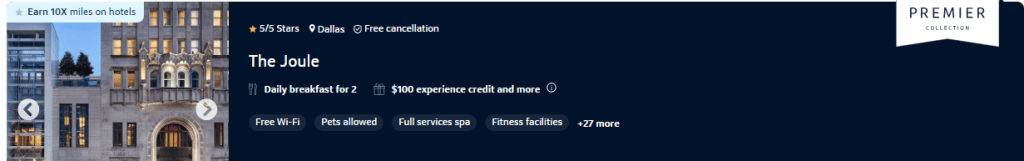

With hotel bookings in the Premier and Lifestyle collections, you’ll earn an experience credit for staying at certain high-tier hotels and resorts that can be put toward room service, dining, additional amenities, and more.

My wife and I used this benefit on a hotel stay for a romantic getaway in Dallas last year and enjoyed an excellent breakfast delivered right to our room complete with mimosas, and French press coffee.

Talk about luxury!

10,000 anniversary miles reward

Every year, Capital One will give you 10,000 miles on your renewal anniversary, worth $100+. Simple enough, starting off with $100 that you can use to offset the annual fee. If you have an eligible travel expense on your card within the past 90 days, you can put these miles to work immediately to help offset your annual fee.

$300 annual travel credit

Each year, you will get a credit that can be redeemed for $300 to put toward a travel expense. This MUST be used on the Capital One Travel portal and is applied during your checkout. This is a use-it-or-lose credit, so make sure you are able to take at least one trip or book a hotel room at least once a year while holding this card.

$100 Global Entry or TSA precheck credit

Another nice to have, but admittedly this isn’t a feature I’ve used yet. I do plan on getting TSA precheck approved since I’m starting to travel more for work and it will be nice to streamline security at the airport. This $100 credit is redeemable once every four years per account.

Airport Lounges

I haven’t been able to take advantage of the Capital One (and partner network) lounge access program yet, but it’s a great program with access to 1,300+ global lounges at no cost. Benefits and amenities will vary from lounge to lounge, but it makes waiting at the airport much more tolerable, especially if you can grab a free cocktail or meal.

Unfortunately, on a recent business trip, I was turned away at the door of the Capital One Lounge in the DFW Airport after a long day of travel and arriving back on my home turf. You MUST have a departing flight to get into the lounge. Lesson learned for next time!

Additional cardholders

With the Venture X, you can add additional cardholders within your family at no additional cost, and your cardholders will get access to the same benefits you have! My wife has a Venture X card through my account and we enjoy not having to pay an extra fee for this benefit. You will NOT get the welcome bonus twice with this approach, but you also only have one annual fee to cover and it’s a far simpler approach than trying to balance out owning two individual Venture X accounts.

Capital One Venture Visa Infinite benefits

The Venture X is part of Visa’s elite line of cards, Visa Infinite. This includes lesser-known but super-premium features and protections. For a complete list, visit this article on Nerdwallet. Some notable inclusions are return and theft protection, trip delay reimbursement, cell phone protection, and travel accident insurance, among some other benefits.

The Wealth Orb Venture X Review

It feels good to carry and spend with the Venture X. Its metal and sleek construction makes it fun to reach for when it’s time to checkout, in addition to knowing that you’re scooping up some great rewards percentages on your purchases.

In my Venture X review, I want to highlight the fact that I don’t travel every single month. I want to dispel the misconception that you have to travel with extreme frequency to benefit from owning a travel rewards credit card.

My wife and I have a 15-month-old toddler at home so notably, we’re not doing a ton of traveling. But that hasn’t been a problem for the trips we have been able to take. In fact, my Capital One Venture X serves as my top-of-wallet card in my Dynamic Trio of reward credit cards. It’s center-stage as my go-to card for expense categories that don’t have a higher reward percentage in other cards in my wallet, like the American Express Blue Cash Preferred (groceries and streaming) and my Costco Anywhere Visa (gas & restaurants).

Despite that, the few trips I have taken with my Venture X have been fantastic.

As I mentioned above, we used the Venture X to book a romantic one-night date night getaway in Dallas, Texas. We stayed at the five-star Joule, part of the Premier collection on the Capital One Travel website. The $100 experience credit we received through our booking plus the 10% back in miles greatly reduced the cost of and otherwise enhanced our stay. Not only did we enjoy a complimentary room upgrade, but the credit also covered our valet and an incredible breakfast delivered to the room.

Cost savings to stretch the vacation budget

More recently, we traveled to wine country – Fredericksburg, Texas to celebrate our wedding anniversary over the Memorial Day weekend. We enjoyed 10% back on our hotel for the trip and used our reward miles and annual travel credit to cover the full cost of the hotel. It meant we could stretch our trip budget and enjoy more wine tastings during our mini vacation and not have to worry as much about the cost. We also bought back a couple of nice bottles of wine for our parents as a thank-you gift for helping watch the baby.

A travel card closely aligns with what I want to be able to use my money for in the long run: as a utility to enjoy amazing experiences with my loved ones and build lasting memories. This anniversary trip was a perfect realization of putting those goals to action and proving out the value of my rewards strategy

Rewards that add up

10% back on hotels and 5% back on flights are excellent reward rates that can generate a lot of savings for travel. For a family vacation, the hotel rewards earned alone can easily cover a nice dinner out on the vacation, or a small family activity. It’s nice being able to earn such a high percentage back.

2% back on everyday spending outside my other reward categories is a nice kicker as well. It helps generate a lot of rewards from our day-to-day spending. Credit card rewards like miles, are also typically treated as rebates by the IRS, so they aren’t taxed. Another way to stretch your dollars if you have the discipline to never pay interest.

the 10,000-anniversary miles plus the $300 travel credit every year already provide an instant $400 against the annual fee of $395, making this card a no-brainer if you’re able to avoid paying any interest and like to travel even a little bit. Even if you’re only taking one trip a year, I’ve found this card to be worth it.

💡💳 If you’re looking for an excellent premium travel credit card that can serve well as a Top-of-Wallet credit card for maximizing rewards, I highly recommend the Capital One Venture X. Get 75,000 bonus miles with the intro offer (a reward value worth $750+) Apply and help support the blog using my sign-up link.

Why did I choose the Venture X over other travel cards?

The Venture X’s annual fee is lower than other premium travel cards, but it also has a simplistic reward structure that aligns with my rewards strategy. I don’t travel all the time, and I’m not going to spend countless hours searching for obscure workarounds and point transfer programs to try to juice out every nickel of spending power on my points/miles. I found the Venture X appealing in that regard. It has great perks and benefits, and I don’t feel bad for simply redeeming my miles 1:1 to cover the travel bookings I make on the Capital One Travel Portal.

I’m more than happy and comfortable just holding a great credit card and using it year after year to scoop up the rewards without paying any interest.

Sure I may look for other cards over time as my needs/wants change, but I’m not one to hop through a bunch of credit cards and jump through a ton of hoops to earn a new welcome bonus every few months. I agree with many of Nick Maggiulli’s points about when it makes sense to maximize credit card rewards.

In my opinion, the Venture X has the most simplistic, but also value-oriented benefits compared to other premium travel cards. It aligns closely with my rewards strategy and how I want to spend and enjoy my miles.

For people who love to shop and convert travel points and transfer to other programs, the Capital One exchange platform and partners leave something to be desired. You may be better off with other premium cards if this is your forte and you consider this a showstopper.

Venture X Review – A consultant’s best friend

During the day, I work as a project manager consultant at an IT consulting company. During and immediately after Covid, we didn’t do a lot of traveling to customer sites, choosing to deliver projects almost entirely remotely. Now, with the era of Covid mostly behind us, I’m starting to do a little more travel for work to get out and visit my clients. It’s nice to be able to connect and meet people in person who I’ve been working closely with for two years now and build an extra layer on those personal relationships.

Fortunately, I don’t have to travel and be away from my family a ton, but it is nice to be able to book my own travel accommodations with my Venture X for my business trips. I earn 5-10% back on those purchases that I get to expense through work, scooping up some extra miles without any cost to my clients or company. It’s a win:win:win.

Plus I know I’m backed by the portal and a great support staff. If something goes really wrong during my travels, I can leverage customer support to resolve the issue faster than if I were to go directly through the airlines.

If you work a job where you have the opportunity to travel and make your own travel purchases to expense (rather than owning or using a corporate credit card) this can make the Venture X all the sweeter.

TLDR review

The bottom line: 5/5 Stars

In my Venture X review, this card easily earns a 5/5 score in my opinion. Apply and get yours today!

Pros:

- High reward percentages on travel categories, plus a 2% catch-all that make the Venture X an excellent top-of-wallet credit card for reward strategies.

- Excellent benefits for the $395 annual fee, more than making up for it if you take at least one trip per year.

- Travel portal is easy to use and is mostly free of any issues.

- No mile expiration or blackout dates.

Cons:

- Those who like to hyper-optimize or transfer miles between travel programs may find the options a bit lacking compared to other premium travel card options.

- Some may find the $395 annual fee expensive.

- If you can’t take at least one trip per year, you’ll lose your $300 annual travel credit. Use it or lose it! (please use it)

Comments