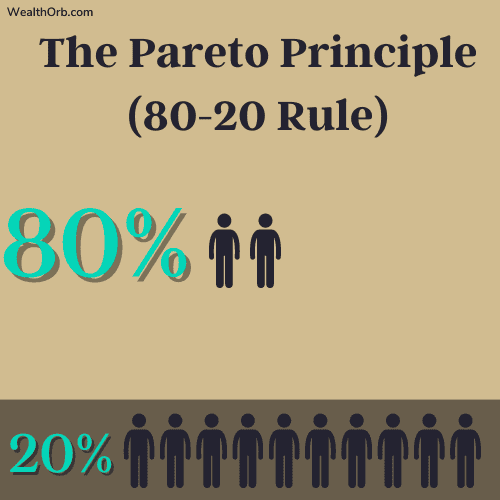

The Pareto Principle (80-20 rule) is one of the most impactful frameworks to build wealth and achieve elevated personal finance. It gives you the tools you need to build effective personal finance habits–starting with the simple basics and then working your way up to a level of knowledge that is multi-faceted and brilliant.

In this key blog post, I will explain the concept of the Pareto Principle (80-20 rule) and its significance in personal finance. We will dive into the history of Vilfredo Pareto, his work, and how you can build lasting wealth with the power of this knowledge. I will also showcase some practical applications of the framework in improving & optimizing personal finance outcomes with some real-world examples.

I get a lot of questions from people on the best way to get started with improving their personal finances or taking things to the next level.

When undergoing the change from being someone who is reactive with money to someone who is proactive, it can feel overwhelming. It’s easy to stray from your comfort zone and get washed away in a swell of financial jargon. Fortunately, there is an easier, more efficient path to better personal finance and wealth building with the Pareto Principle (80-20 rule).

I’ve spent countless hours studying Pareto’s work and leveraging his frameworks to build out my own expertise & systems in personal finance. The 80-20 rule is one of the major inspirations of Wealth Orb and my concept of elevated personal finance.

Even if you are someone more advanced at personal finance, there is a ton of value to be gained from the 80-20 rule. Once you learn and internalize this framework, it’s easy to leverage to get ahead in any aspect of life that’s important to you.

Let’s dive in!

The history of Vilfredo Pareto, and the Pareto principle (80-20 rule)

Vilfredo Pareto was born in Italy in 1848. Throughout his life, he was an incredible Polymath that made several key contributions to economics–including the Pareto Principle (80-20 rule). His contributions would go on to form the basis of the modern study of microeconomics.

In addition to his incredible contributions to economics, Pareto also studied civil engineering, sociology, political science, and philosophy.

As an avid gardener, Vilfredo Pareto witnessed an interesting pattern emerging with the plants in his garden. A small minority of 20% of his plants were producing 80% of his fruit yields.

As he took his studies further and branched into the world of economics, Vilfredo Pareto observed that 80% of the land (wealth) in Italy was owned by 20% of the population.

Pareto didn’t further share or publicize his discoveries during his lifetime. It wasn’t until the early 1950s that an engineer named Joseph Moses Juran built upon Pareto’s discovery of his garden & the wealth distribution in Italy by landowners and applied it to modern business & manufacturing. Today, the 80-20 rule is a common axiom in business.

In his 1951 manual titled the Quality Control Handbook, Juran coined the Pareto Principle based on Vilfredo Pareto’s findings and found that it also applied to crime incidents and manufacturing.

Specifically, Juran studied a paper mill that discovered 12% of defect types in paper manufacturing resulted in 80% of quality costs within the company. By focusing on and prioritizing fixing those specific defects, the paper mill’s quality control costs fell drastically.

The mathematics of a Pareto Distribution–a power law

Pareto’s findings would form the basis of the Pareto Principle & 80-20 rule.

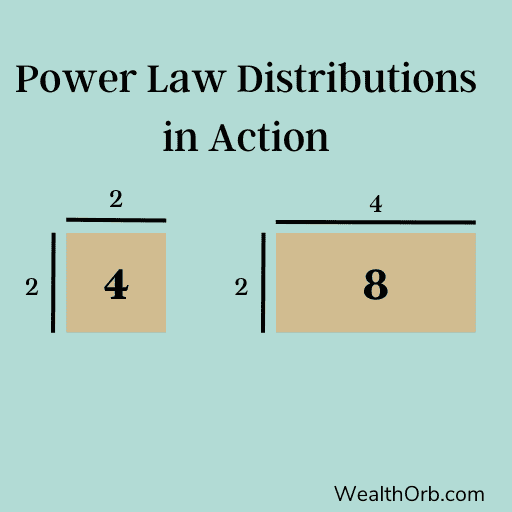

Mathematically, this relationship is what is now known as a power law or Pareto Distribution–a functional relationship between two numbers where a change in one quantity results in a relative change in the other proportional to the power of the change.

The math can get extremely theoretical & technical, but here’s a simple example of how a power law function works:

You have a square that is 2 feet long and 2 feet wide. Its area is equal to length multiplied by width, so we know the square has an area of 4 feet.

If we were to double only the length of the square to 4 feet and keep its width set at 2, the resulting rectangle’s overall area will still double to 8 (relative to the starting square) since 2×4 = 8.

We didn’t have to double both the length and width of the square to double the area of the resulting rectangle as a whole after changing one of its dimensions. Doubling one of the two inputs will double the output as a whole.

If we consider the area of the square in terms of only its length, if the length is doubled then the shape’s overall area is multiplied by a factor of 4.

The nuances & common pitfalls of the Pareto Principle

It’s easy to get caught up in the numbers 80 & 20–but the principle of the 80-20 rule is much more important than the numbers themselves. The framework is incredibly malleable and we can use that to our advantage.

Put the 80-20 rule in a soup pot and crank up the heat, and it will boil down to the fact that a small subset of inputs will result in the largest share of the key outputs.

The actual numbers themselves are irrelevant. The fact that 80 & 20 adds up to 100 is also irrelevant.

The principle still applies at 60/40, 75/25, 80/15, 90/10, 97/, 99/1, or any other ratio you could come up with–so long as there is a present minority that accounts for a majority. Take Juran’s paper mill company study for example–12% of the defects resulted in 80% of the costs. The numbers don’t have to be exactly 80 & 20 for the principle to apply.

It’s also a common pitfall to the 80-20 rule to think that by prioritizing the 20% of the most important inputs you can completely ignore the other 80%–these are still important, even if they are not prioritized first.

- As a student, you would prioritize studying the subset of topics that are most likely to be covered in the exam but shouldn’t ignore the remainder of the chapter content that will also be included if you want to do well in the class.

- As an employee, you should prioritize the tasks that will create the big wins for you (your career) and your organization. But small, less unimportant tasks that are left undone for too long will eventually creep back up and punish you for neglecting them.

- If a small subset of players in a sports match are responsible for a majority of the team’s points, as the coach you would still need to invest resources in improving team synergy and how the other players are contributing to the outcome of the match.

Another pitfall is thinking that the most impactful things to focus on with the 80-20 rule will always be the easiest. This is entirely false–sometimes, the most impactful things we can do to generate the best, most desirable outcomes will also be the hardest.

Endless planning with little action will minimize or otherwise invalidate the benefits of the Pareto Principle. It’s best to just get started and take action. You can figure out additional details as you go.

Real-world examples of the Pareto Principle

In 2002, Microsoft’s CEO, Steve Ballmer found that 80% of software end users only use 20% of a software application’s full set of features. They dug in further and learned that 80% of application errors and crashes in Windows and Microsoft Office were caused by 20% of the total amount of bugs detected in the broader pool.

“One really exciting thing we learned is how, among all these software bugs involved in the report, a relatively small proportion causes most of the errors,” Ballmer wrote. “About 20 percent of the bugs causes 80 percent of all errors.”

Steve Ballmer.

The 1992 United Nations Development Program report showed that the world’s distribution of wealth was extremely uneven. The distribution of world GDP in 1989 closely mirrored the Pareto Principle:

| Quintile of Population | Income |

|---|---|

| Richest 20% | 82.70% |

| Second 20% | 11.75% |

| Third 20% | 2.30% |

| Fourth 20% | 1.85% |

| Poorest 20% | 1.40% |

Understanding the 80-20 Rule in personal finance & achieving financial literacy

Now that you have a grasp of the Pareto Principle, you can apply it to personal finance. Learning to become financially literate is one of the most important skills you can learn to improve your life and the lives of your loved ones. Money is not the key to happiness, but it does buy comfort and the opportunity to enjoy incredible experiences with the ones who matter most.

Taking what you now know about the 80-20 rule, you need to start by mastering the fundamentals and the ~20% of inputs that will yield ~80% of the outcomes you want to achieve.

After prioritizing and mastering these basic, high-impact fundamentals it makes sense to further venture into the complexities of the remaining 80% of subject matter material that will further improve your outcomes.

There’s no need to understand what an equity-linked note (ELN) is and how it may complement your portfolio when you could just be taking advantage of your company’s 401k match and investing in low-cost total market index funds that have been proven to outperform more complex investment instruments or actively managed investment funds over long periods of time.

Practical examples of using the 80-20 rule to build wealth

When it comes to building wealth, the Pareto Principle (80-20 rule) is the perfect framework. There are many practical ways to identify the crucial 20% of financial inputs that yield the 80% of desirable results you want to achieve.

- To improve financial literacy as a beginner, you only need to focus on a small subset of learning before advancing to more complex topics. You are better off understanding simple personal finance skills like income, spending, budgeting, savings, investing, and wealth protection rather than combing through complex IRS documentation so dry it will sting your eyes.

- Saving & investing at least 20% of your income (both before and after tax) automatically before spending the other 80%.

- Prioritizing paying off the subset of your debt with the highest interest rate. Start by understanding your debt and building a paydown plan.

- Focusing on the most efficient ways to boost your income–either through a side hustle or by improving your day-job situation or negotiating a pay raise.

- Finding ways to reduce the 20% of spending categories in your budget that are responsible for 80% of your overall monthly spending.

- Building ironclad credit card habits before optimizing credit card rewards strategies.

- You don’t need to know how to read & understand a form 10-k filing, balance sheet, income statement, or statement of cash flow to start investing–why not diversify and invest in low-cost total market index funds instead? (I love VTI or VOO).

Maximizing efficiency and results in personal finance with the Pareto Principle

As you work on building financial literacy and mastering the essential fundamentals, it is natural to want to take the next step into what I call elevated personal finance.

Wealth Orb is committed to helping people master the fundamentals of personal finance with the 80-20 rule before moving into the remaining 20-80 of elevated personal finance with optimization & mastery.

As you learn and master the basics, spend additional time wading into deeper waters and looking for ways to further optimize and improve your financial systems & tooling. Start to learn about things like tax planning & optimization by retirement account, optimizing income generation from your emergency fund, wealth preservation & risk tolerance thresholds, and securing different sources of passive income.

Time is the great equalizer. With enough time, the systems, tools, and processes we create can compound with incredible efficacy.

I’m a firm believer in looking for ways to personalize and optimize personal finance over the long run–taking care to live life outside of the spreadsheet and enjoy incredible moments with incredible people.

🟢 Orbs of Wisdom

Orbs of Wisdom are actionable insights from my blog content that you can immediately adopt in your day-to-day to elevate your personal finances.

Incremental wins and sustainable strategies compound over time, turning seemingly insignificant tasks into the building blocks of incredible future milestones.

- Identify the small subset of inputs that will have the greatest effect on the outputs you want to achieve. Prioritize these first, but don’t completely ignore the remainder of the inputs.

- Quantify your objectives and attach numbers to your goals–this will help you take a data-driven approach and objectively track your progress over time.

- Build a sturdy understanding and proficiency in personal finance, mastering the basic fundamentals before taking a deep dive into more advanced topics.

- Understand the limitations and pitfalls of the Pareto principle framework–don’t get too caught up in the math and exact numbers. lean into the spirit of the framework instead.

- Read other Wealth Orb content on the blog and view it through the lens of the 80-20 rule. How can you apply what you’ve learned in this post to boost your understanding of my other content?

Conclusion

Ultimately, the 80-20 rule will reward you greatly for understanding it and looking for ways to implement it in your life. Beyond the incredible benefits it has helped me realize in my own personal finances, I’ve applied the 80-20 rule in my fitness and health to lose over 70 pounds since the Summer of 2022, improve my relationships and career trajectory, and improve the things that matter to me in life.

Once you have leveraged the 80-20 rule in your personal finances, look to further optimize your financial journey and achieve elevated results. I promise it will be worth it and make a big difference in your life.

Reader suggestions for discussion

💬 How have you leveraged the parts of the 80-20 rule in your life and personal finances without realizing it?

For those who used it before, how has the 80-20 rule made a difference in your life?

Have any questions or comments? Join the discussion in the comments sections below!

Comments