With higher interest rates, cash is performing remarkably well in June, 2024. In this post, I’ll show you how to better optimize your emergency fund savings to combat inflation, build wealth, all while sheltering your family from financial hardship and unplanned expenses without impacting your liquidity. There’s never been a better time to optimize for more earning power on your cash!

Determine liquidity and find a balance that works for your family

The point of an emergency fund is to cover unexpected expenses and shelter your family from financial hardships. Liquidity and capital preservation is extremely important and helps protect the value of your cash in the case of an emergency, or recession/market crash. Brokerage investments can be liquidated, but if the sky is falling in the market, it’s worth trying to avoid panic selling at a steep loss if at all possible.

In a recent post, I wrote about the simple reasons why your emergency fund is overfunded. I highly recommend the read before jumping in and trying to optimize your savings with the concepts from this article.

Ideally, your 100% FDIC-insured HYSA savings should give you enough time and runway for less-liquid risk-free investments to mature without taking a penalty. This way, you can expose yourself to more upside without risk of running out of savings before you can access the rest of your emergency fund that is tied up in other investment vehicles.

It’s possible to build a laddered savings strategy for your emergency fund once you have two or months of expenses saved, but it is more comfortable and easier to manage with a three+ month savings fund established.

Some starting points for liquidity

Here are some examples of how various emergency funds amounts can be structured with a laddered approach:

2-month emergency fund: 75% HYSA savings, 25% ultra-short-term CD while you work to save to 3-months of expenses. With less than 3-months of expenses saved up, I would recommend 100% HYSA savings.

3-month emergency fund: 66.66% HYSA balance, 33% short-term CD/treasuries OR 100% HYSA balance.

6-month emergency fund: 50% HYSA balance, 50% short-term CDs/treasuries.

1-year emergency fund: 50% HYSA balance, 25% 3-month CD/treasuries, 25% 6+month CD/treasuries.

Here’s how I break down liquidity ratings:

Highest: instant liquidity, 100% pure cash, and instant transfers between checking/savings accounts.

High: 1-5 business day transfer time to get the cash into my primary banking account(s).

Medium: 1-3 months for full liquidity, or the ability to liquidate and take a loss or penalty by discounting the asset for a quick sale.

Low: 6+ months for full liquidity, or the ability to liquidate and take a loss or penalty by discounting the asset for a quick sale.

How I structured my emergency fund

Here is how I have my family’s 6-month emergency fund structured:

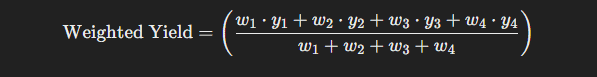

| Holding | Weight | Yield | Liquidity |

|---|---|---|---|

| HYSA Savings Account | 25% | 4.60% | Highest |

| Robinhood Brokerage Cash Sweep (FDIC insured) | 35% | 5.00% | High |

| Short-term CD Ladder | 35% | 5.45% | Medium/Low |

| Short-Term Treasury Bills | 5% | 5.25% | Medium/High |

My emergency fund blended APY rate = 5.245%

I keep $1,000 in my checking account at all times and that’s it. I can instantly move money from my savings to checking, and my bank will automatically withdraw from my savings with overdraft protection in the case I spend more than $1,000. I do this since my checking account only earns 0.6% APY. More money in my HYSA = more interest earned.

With today’s rates, cash earns a great return compared to just a couple of years ago. It’s entirely possible to combat or even beat inflation with just an HYSA. Notice how everything I have placed is FDIC insured with the exception of my short-term treasuries. Realistically, that means zero risk of losing my money since it is spread between accounts and is well under the standard $250,000 of FDIC insurance coverage.

Within the 35% of my family’s emergency fund that is allocated to CDs, here’s how my CD ladder is structured:

| Holding | Weight | Yield | Liquidity |

|---|---|---|---|

| 3-month CD | 60% | 5.45% | Medium |

| 6-month CD | 40% | 5.45% | Low |

Why lock away money in a 6-month CD that earns the same APY as my 3-month? To hedge against a drop in rates. I can hold onto my yield for twice the duration in the case rates do drop. But this can also have the opposite effect. If rates climb again, I’m locked into a subpar rate for longer before the money can be freed up for better yields.

Every month, I open up new 3-month CD positions. After my initial 3-month CDs elapse, my CDs will ‘churn’ and give me access to revolving cash in regular one-month intervals while I collect the interest. This gives me the option of manually opening a new CD, or in the case of an emergency, access to my cash without paying penalties or needing to sell my CD on the secondary market at a discount.

A little extra effort on my part to earn a higher yield on my cash, but I get a lot of comfort and sleep well at night knowing I can access portions of my CD allocations on a predictable and recurring basis every month.

While this strategy does give me higher liquidity, I am subject to potentially lower (or higher) rates when the time comes to renew the CD if I do not need access to the cash. Because of the value I put on liquidity, I am more than comfortable with how my CD ladder is structured as well as its overall allocation size against my overall emergency savings fund.

As I wrote in my HYSA post, I don’t chase marginally higher rates just for the purpose of chasing higher rates. It’s difficult and time-consuming to change banks, update autopays, direct deposit, utility accounts, etc. Instead, I picked a great bank with a history of raising APY rates on HYSAs that is competitive within the market.

Sure, I could switch from SoFi to CIT Bank and go from 4.60% > 5.00% on my HYSA, but I’d also have to update all my accounts and would lose access to my linked checking/savings accounts that give me instant transfers between accounts and 100% overdraft protection on my checking account. These are all features I value, so I don’t mind staying where I am at.

Instead, I’ll continue to leverage SoFi as my primary bank and augment and optimize my emergency fund with the strategies discussed in this post.

💰Ready to ditch your bad bank for a great one? I recommend SoFi. Help support the blog and upgrade your finances with a great HYSA at SoFi. Plus, you’ll earn a great welcome bonus if you set up direct deposit!

What about short-term treasuries?

Treasuries can be a great addition to an emergency fund investment strategy. Short-term treasuries have Medium/High liquidity. Treasury bills and notes have historically been a very low-risk investment, though rates (and prices) on those notes can vary. Unlike new-issue CDs which are locked in (at the cost of liquidity), values of treasuries change with the market. At the time of writing, CDs have higher yields compared to short-term treasuries at the cost of some liquidity.

If you are looking to include short-term treasuries in your family’s emergency fund investment+ strategy, 20% or less should be a healthy allocation. Remember, you want to have healthy liquidity in your emergency fund and enough runway with your HYSA to get access to any low/medium liquidity investments before your primary savings dry up in the case of an emergency or economic hardship for your family.

It’s also entirely possible that treasuries will begin to yield higher overall returns compared to CDs since the bond can also appreciate in value and fluctuate with the market.

Note, bonds as part of an emergency fund are treated separately from overall brokerage/retirement investment strategy and are meant to help augment income potential of the emergency savings fund. I also recommend bonds as a part of a healthy, diversified portfolio for some stability and shelter from economic volatility. To optimize bond holdings (outside of emergency fund+ investments), you should look to hold bonds in tax-advantaged accounts to optimize your tax liability.

I hold both Series I Bonds issued from Treasury Direct and Vanguard’s low-cost total bond market ($BND) ETF as part of my retirement investment portfolio.

In conclusion, now is a great time to augment your family’s emergency fund strategy to earn more income. Every penny & dollar matters, and it’s easy to earn higher APY yields with little to ZERO additional risk, all while customizing and adjusting your liquidity tolerance and making sure you are covered in a pinch.

💬 Reader suggestions for discussion

How do you maximize your saving fund’s income potential? Have any questions or comments? Join the discussion in the comments sections below!

Comments